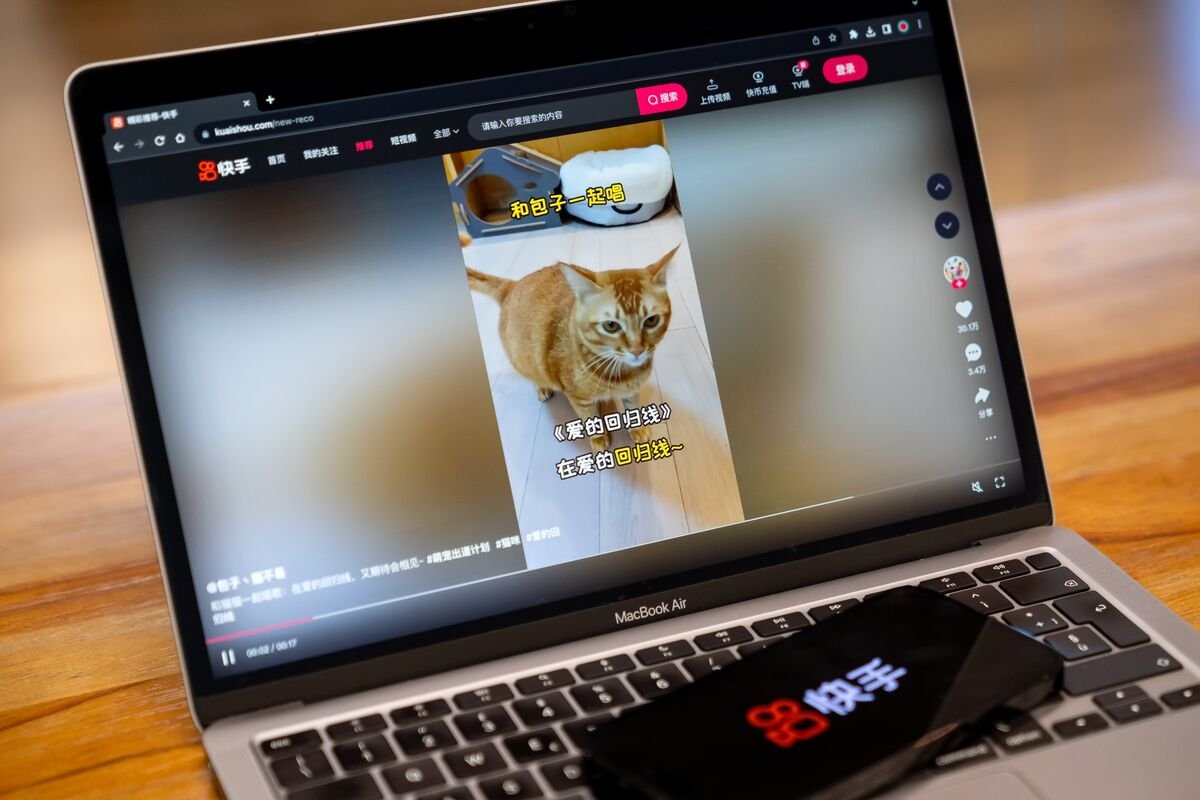

Kuaishou Technology's strategic pivot to AI-powered video generation fuels investor confidence and market repositioning in China's competitive tech landscape.

Kuaishou Technology's HK:1024 shares have delivered an 88% return to investors over the past 12 months, significantly outperforming China's tech sector. This surge correlates directly with the adoption of its Kling AI video generator, which has gained 60 million users since its launch according to Bloomberg analysis. The Beijing-based company, historically overshadowed by ByteDance's TikTok, now commands a market capitalization of approximately $35 billion USD as of January 2026 closing prices.

Market Context: From Laggard to AI Contender

Kuaishou's transformation marks one of the most rapid AI pivots among major Chinese tech firms. Where competitors allocated years to foundational model development, Kuaishou leveraged its short-video infrastructure to deploy Kling as a vertically integrated solution. User metrics show average engagement times increased 22% quarter-over-quarter among Kling adopters, with creator output volume growing 47% year-over-year. These metrics proved critical for investor reevaluation of a company whose stock traded at a 40% discount to sector peers just 18 months ago.

Strategic Implications

Three factors underpin Kling's market impact:

- Monetization Pathways: Early advertising tests show 34% higher CPM rates for AI-generated content versus user-created videos, with sponsored template integrations driving $120 million in Q4 revenue

- Infrastructure Synergies: Kling's compute demands are partially offset by Kuaishou's existing content delivery network, reducing cloud costs by an estimated 18% versus standalone AI startups

- Regulatory Positioning: As China tightens generative AI regulations, Kuaishou's established compliance framework provides operational advantages over newer entrants

Competitive Landscape

Kuaishou now commands 19% of China's AI-generated video market according to Analysys International, trailing ByteDance (31%) but ahead of Tencent (15%). This positions Kling as a key differentiator in the broader streaming war, where user attention spans continue fragmenting. Notably, 41% of Kling's users migrated from competing platforms according to internal surveys, suggesting genuine market share capture.

Investor Calculus

Financial analysts revised Kuaishou's 2026 revenue projections upward by 12-15% following Kling's adoption metrics. The AI tool's rapid scaling provides margin expansion opportunities through:

- Reduced creator acquisition costs (down 28% YoY)

- Premium subscription conversion rates exceeding projections at 8.2%

- Enterprise API licensing deals with e-commerce platforms

Forward Outlook

Sustainability questions remain regarding content moderation scalability and GPU supply chain constraints. However, with Kuaishou trading at 24x forward earnings versus sector average of 31x, analysts see continued upside potential. The company's next validation point arrives with Q4 earnings on February 15, where investor focus will center on Kling's contribution to overall revenue mix and international expansion plans.

Data sources: Bloomberg terminal filings, Kuaishou investor relations materials, Analysys International Q4 2025 market report.

Comments

Please log in or register to join the discussion