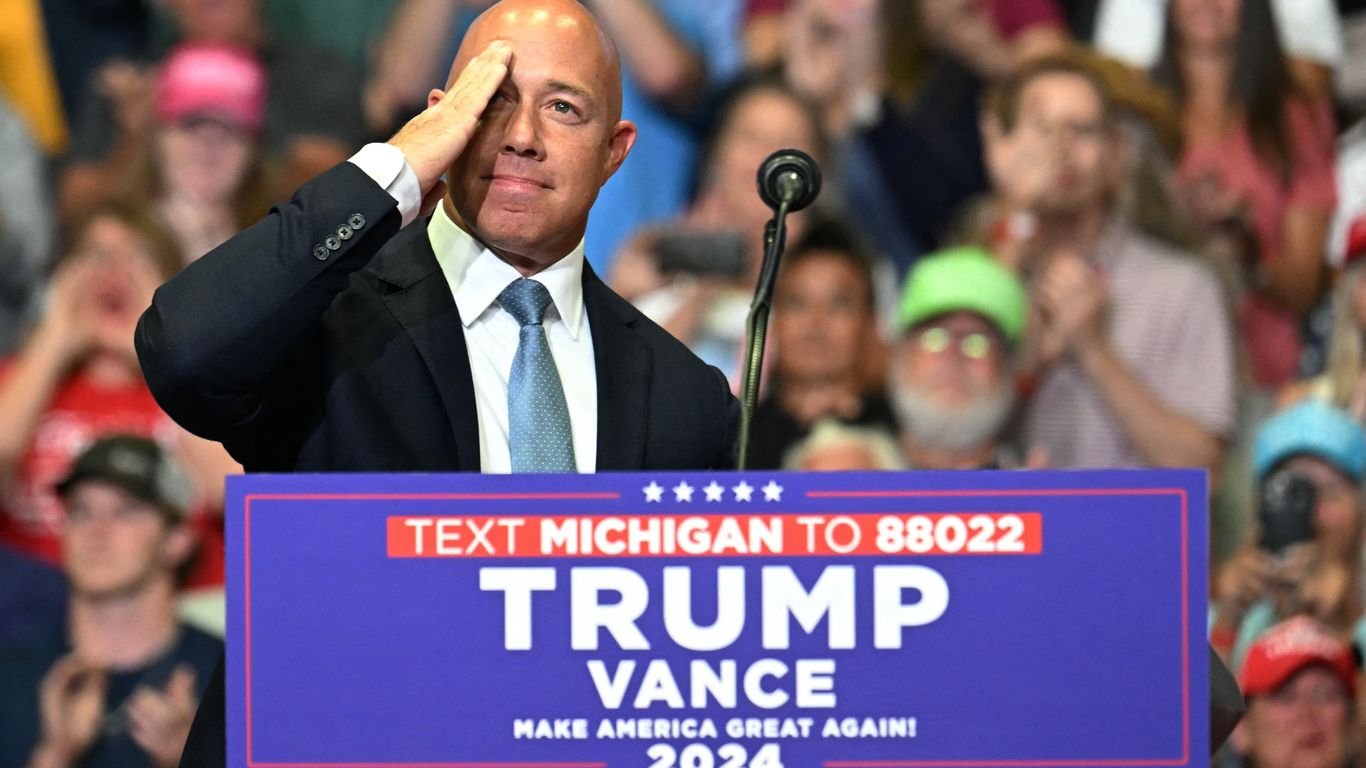

Florida Representative Brian Mast faces political backlash from MAGA-aligned groups over his position on AI chip export controls, highlighting growing tensions between tech policy and intra-party dynamics.

Intra-party conflict has erupted over semiconductor policy as MAGA-aligned groups target Republican Representative Brian Mast of Florida for his stance on artificial intelligence chip export regulations. The controversy centers on Mast's support for tighter controls on advanced AI chip shipments to geopolitical rivals, a position facing opposition from factions prioritizing short-term business interests over national security concerns.

Market Context: The $500B Semiconductor Standoff

The global semiconductor market, valued at $573 billion in 2023 and projected to reach $1.3 trillion by 2032 (Statista), forms the core of this dispute. NVIDIA ($2.2T market cap), Intel ($128B), and AMD ($257B) dominate the AI accelerator segment, where export restrictions could impact up to $15 billion in annual revenue according to Bernstein analysis. Current regulations already limit sales of chips exceeding certain performance thresholds to China, but Mast advocates expanding these controls to include more mid-tier chips used in military AI applications.

Strategic Implications for U.S. Tech Leadership

This confrontation exposes three critical fault lines:

- Security vs. Revenue: Defense officials warn unfettered exports could accelerate adversaries' military AI by 18-24 months, while chipmakers argue excessive restrictions cede market share to Chinese competitors like Huawei and SMIC

- Manufacturing Reality: Despite CHIPS Act subsidies, U.S. production accounts for just 12% of global semiconductor manufacturing (SIA), complicating decoupling efforts

- Political Calculus: Mast's stance aligns with defense hawks but conflicts with business-friendly Republicans seeking to protect semiconductor revenues that contributed $166 billion to Florida's GDP in 2023

What It Means: Policy Crossroads

The targeting of Mast signals MAGA's growing influence over tech policy debates, with three likely outcomes:

- Regulatory escalation could trigger reciprocal restrictions affecting 28% of U.S. chip firms' overseas revenue

- Investment diversion may accelerate as companies like NVIDIA shift more AI chip production to Singapore and Malaysia to bypass controls

- Political realignment where national security-focused Republicans could face well-funded primary challenges from business-aligned opponents

With AI chip exports becoming a proxy for broader tech sovereignty debates, Mast's predicament illustrates how semiconductor policy now sits at the intersection of global competition, corporate profits, and political survival. Semiconductor stocks dipped 1.3% on the news (SOXX ETF), reflecting market sensitivity to regulatory uncertainty.

Comments

Please log in or register to join the discussion