Nintendo President Shuntaro Furukawa addressed concerns about rising memory costs potentially affecting the Switch 2's price, revealing the company's strategic stockpiling efforts while remaining noncommittal about future pricing adjustments.

The global memory chip shortage, driven by explosive demand from AI data centers, has already sent prices soaring for gaming PCs. Now, the crisis is threatening to impact the console market as well. In a recent interview with Kyoto Shimbun, Nintendo President Shuntaro Furukawa was directly questioned about whether rising component costs could force a price increase for the newly launched Switch 2.

The Patents Watch Bluesky account provided translations of key excerpts from the paywalled Japanese publication. When pressed on the possibility of a Switch 2 price hike, Furukawa's response was measured but noncommittal. "I cannot comment on hypotheticals," he stated, declining to guarantee that the console's current Manufacturer's Suggested Retail Price (MSRP) would remain unchanged.

Nintendo's Defensive Supply Chain Strategy

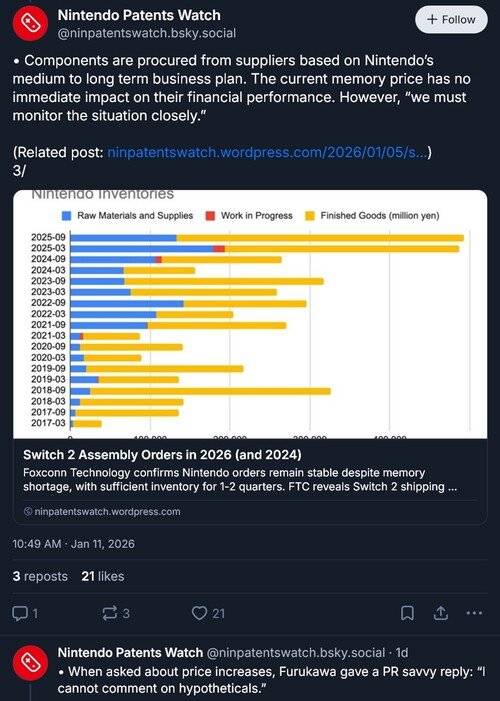

Despite the uncertainty, Furukawa offered some reassurance. He explained that stockpiling essential components is a core element of Nintendo's "medium to long-term business plan." This proactive approach means the company likely has a substantial inventory of critical parts, including the LPDDR5X memory that powers the Switch 2. This mobile variant of DDR5 RAM is the same type of memory experiencing the most severe shortages and price hikes.

By securing components well in advance, Nintendo appears insulated from immediate market volatility. Furukawa explicitly denied that rising memory costs would affect the company's profitability in the near term. This strategy contrasts sharply with many PC manufacturers and smaller hardware makers who are forced to buy components on the spot market at inflated prices.

Furthermore, Nintendo may be protected by long-term contracts with memory manufacturers. While many suppliers are now refusing to lock in fixed prices due to the unpredictable market, Nintendo's established relationships and bulk purchasing power may have secured favorable terms that won't expire for some time. However, Furukawa acknowledged the company is closely monitoring how the AI-fueled shortage develops, as a crisis that extends for years could eventually exhaust these buffers.

The Lingering Shadow of Tariffs

Memory costs aren't the only external pressure on Nintendo's pricing strategy. Tariffs have already forced the company to adjust its financial planning. While the Switch 2 launched at its expected $449.99 price point, tariffs imposed on imported electronics impacted the original Switch and its accessories, leading to price increases for those products.

Furukawa admitted these added fees have already influenced Nintendo's financial outlook. The concern is that a cascade of rising costs—from both tariffs and components—could eventually necessitate a price correction for the Switch 2 itself. However, the president also emphasized a key business objective: getting the new hardware into as many hands as possible. A price increase would run directly counter to that goal, especially as the console faces its own sales headwinds.

Sales Performance and Market Context

Interestingly, the interview occurred as the Switch 2 shows signs of slowing momentum in several key markets. During the 2025 holiday season, the console's retail performance lagged behind the original Switch's trajectory in 2017. While stock levels have stabilized in regions like North America and Europe, Japanese retailers are still struggling to meet persistent demand.

This creates a delicate balancing act for Nintendo. On one hand, the company must manage component costs and supply chain disruptions. On the other, it needs to maintain an accessible price point to drive adoption. The availability of cheaper, region-free handheld alternatives could make consumers more price-sensitive, meaning any increase might significantly dampen upgrade enthusiasm.

For now, Nintendo's forward-looking procurement strategy appears to be shielding consumers from the worst of the memory price crisis. But with some analysts predicting the shortage could last until 2028, the company's long-term contracts and stockpiled inventory may only be a temporary solution. Furukawa's refusal to rule out a future price increase suggests that while current MSRP is safe, the situation remains fluid.

Sources: Kyoto Shimbun (Japanese, paywalled), Nintendo Patents Watch Bluesky account

Comments

Please log in or register to join the discussion