Enterprise SSD pricing has skyrocketed 257% in nine months, creating a 16x cost gap with HDDs and forcing datacenters to adopt hybrid storage architectures to maintain financial viability.

The semiconductor storage market is undergoing a seismic shift driven by AI infrastructure demand, with enterprise SSD prices now 16 times higher than equivalent HDD capacity. This unprecedented pricing divergence is fundamentally altering datacenter storage economics, making hybrid SSD-HDD deployments not just preferable but financially essential for most organizations.

The Price Explosion: Numbers Behind the Crisis

VDURA's analysis, published via Blocks and Files, reveals staggering price increases between Q2 2025 and Q1 2026. A 30TB TLC enterprise-grade SSD that cost $3,062 in mid-2025 now commands nearly $11,000—a 257% increase. Meanwhile, HDD pricing rose more modestly by 35% during the same period.

This disparity has transformed storage cost ratios dramatically. The price gap between SSD and HDD capacity expanded from 6.2x in Q2 2025 to 16.4x in Q1 2026. For datacenters planning multi-petabyte deployments, this represents a fundamental budgeting crisis.

Hybrid Architecture: The New Economic Imperative

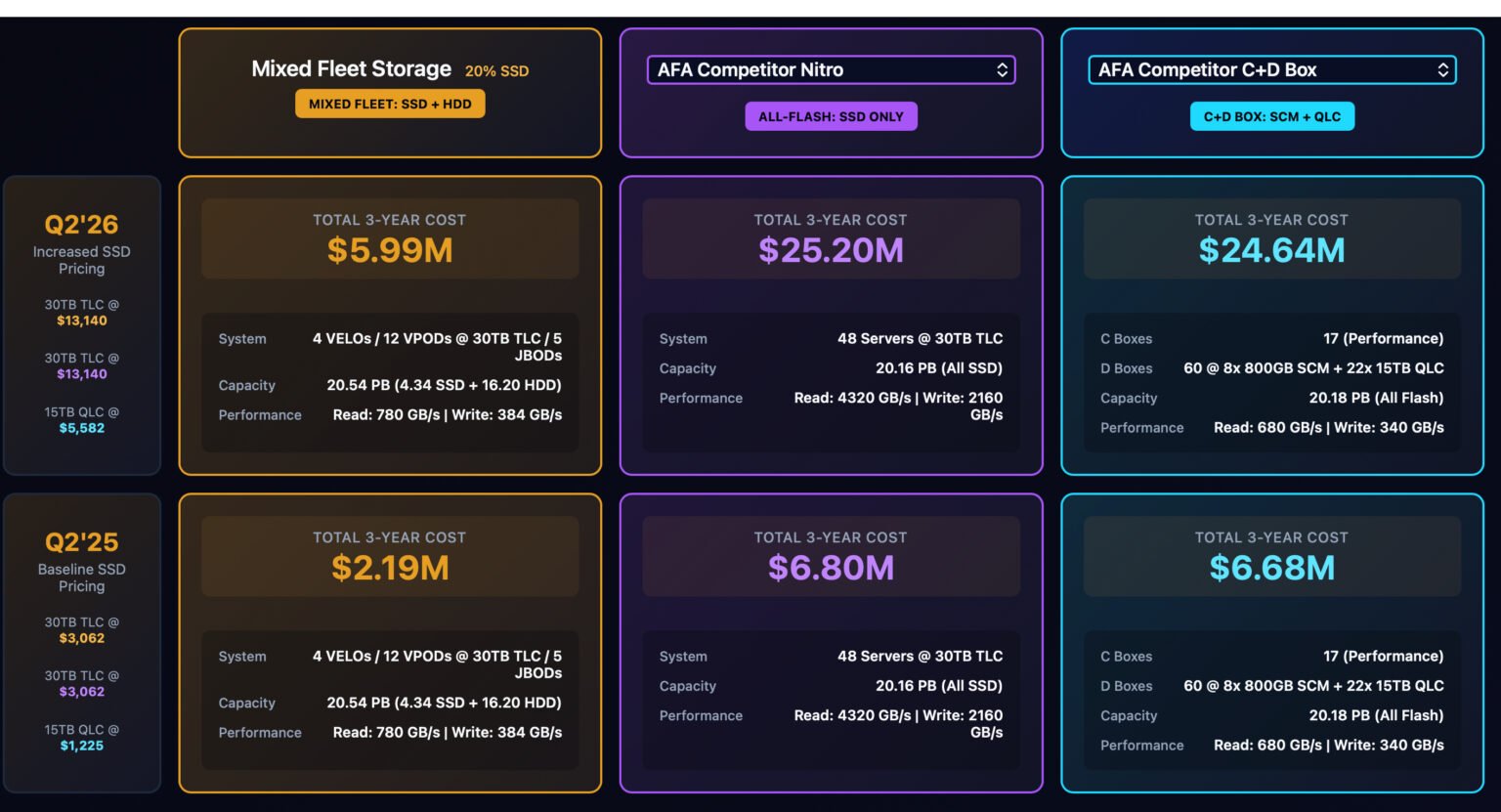

VDURA's cost modeling demonstrates why hybrid storage is now unavoidable. Comparing a mixed fleet system—servers equipped with both SSDs for caching and HDDs for long-term storage—against an equivalent SSD-only setup reveals stark financial differences. The three-year ownership cost for the hybrid configuration was $5.99 million, compared to $25.20 million for the SSD-only equivalent—a 76% cost reduction.

This economic pressure is forcing enterprises to completely rebuild server budgets. Storage quotes become obsolete within months, making long-term planning nearly impossible. The traditional approach of using SSDs for all performance-critical workloads is becoming financially untenable for all but the most latency-sensitive applications.

Supply Chain Context: Why This Is Happening

The crisis stems from fundamental supply-demand imbalances in NAND flash manufacturing. Kioxia, a major NAND flash provider, has indicated the shortage could persist into 2027, as AI infrastructure demand continues to outpace production capacity expansion. This isn't merely a temporary market fluctuation but a structural constraint in semiconductor manufacturing.

The AI boom has created unprecedented demand for high-performance storage. Training large language models requires massive amounts of fast storage for checkpointing and data loading, while inference workloads need low-latency access to model weights and datasets. This demand has absorbed nearly all available enterprise SSD capacity.

HDD Market: Not Immune to Pressure

While HDDs remain significantly cheaper than SSDs, they face their own supply constraints. Hard drive availability is reportedly on backorder for two years due to AI demand, and prices have increased 46% since September. This suggests the entire storage market is under stress, not just the NAND flash segment.

The HDD shortage primarily affects high-capacity drives (18TB and above) needed for cold storage and archival workloads. Even with their lower per-terabyte cost, the extended lead times complicate datacenter expansion plans.

Strategic Implications for Datacenters

Organizations must now carefully tier their storage workloads. Performance-critical applications requiring sub-millisecond latency may justify SSD-only configurations, but most workloads can tolerate the higher latency of HDDs for bulk storage. The optimal architecture typically involves:

- SSD Tier: NVMe SSDs for hot data, caching layers, and metadata

- HDD Tier: High-capacity HDDs for warm/cold data, archives, and backups

- Intelligent Tiering: Automated data movement between tiers based on access patterns

This hybrid approach requires more sophisticated storage software but delivers substantial cost savings. VDURA's analysis shows the financial benefits outweigh the complexity costs for most deployments.

Market Outlook and Recommendations

The storage market shows no signs of normalization before 2027. Enterprises should:

- Extend procurement timelines: Storage quotes have short validity periods; build flexibility into budgeting

- Prioritize workload analysis: Identify which applications truly require SSD performance

- Consider capacity planning: HDD backorders mean ordering well in advance of needs

- Evaluate software solutions: Storage management platforms that automate tiering become more valuable

The current environment favors storage software providers that can optimize across heterogeneous hardware. Solutions that intelligently manage data placement between SSD and HDD tiers deliver immediate ROI in this pricing environment.

Conclusion: A New Storage Paradigm

The 16x price gap between SSDs and HDDs represents more than a temporary market anomaly—it signals a fundamental shift in datacenter storage economics. While NAND flash remains essential for performance-critical applications, the economics now dictate hybrid architectures for the majority of enterprise workloads.

This shift will likely accelerate innovation in storage software, data placement algorithms, and tiered storage architectures. Organizations that adapt quickly to this new reality will maintain cost competitiveness while those clinging to SSD-only strategies face unsustainable budget pressures.

The AI revolution continues to reshape not just compute and networking infrastructure, but the foundational storage layer that supports it all. Understanding and adapting to these cost dynamics will be critical for any organization building or expanding datacenter capacity in the coming years.

Comments

Please log in or register to join the discussion