Appfigures reports global app downloads fell 2.7% in 2025 while consumer spending surged 21.6% to $155.8 billion, driven by subscription models and non-game app growth.

New data from Appfigures reveals a pivotal shift in mobile app economics: While global app downloads declined for the fifth consecutive year, consumer spending reached record highs through subscription-driven revenue models. This divergence highlights how monetization strategies are transforming the app ecosystem.

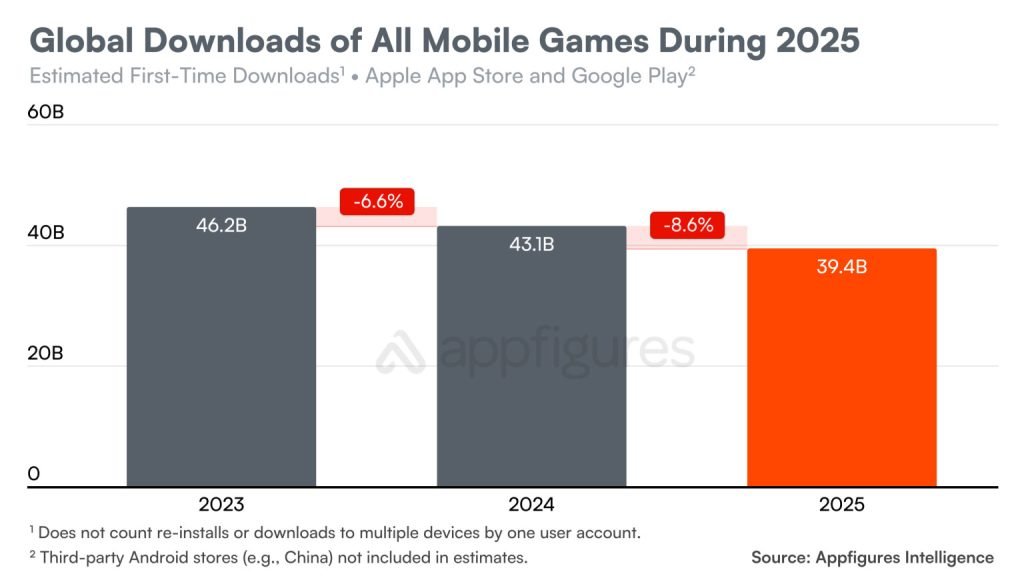

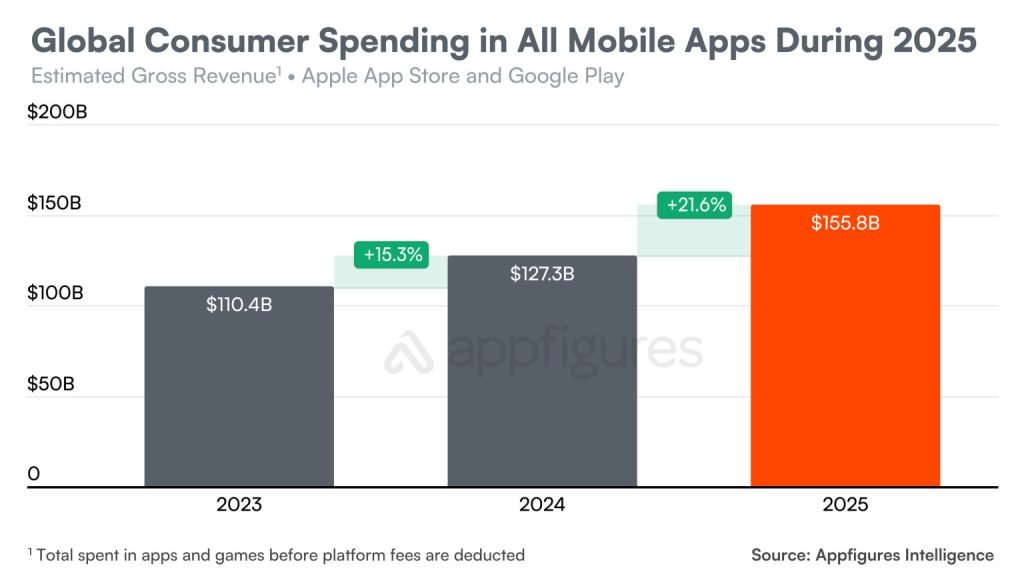

According to Appfigures' 2025 annual report, global app downloads decreased by 2.7% year-over-year to 106.9 billion, continuing a downward trend that began after pandemic-era peaks. Downloads have fallen steadily from 135 billion in 2020 to 109.8 billion in 2024 before this latest dip. However, consumer spending tells a different story – surging 21.6% to $155.8 billion globally.

The subscription model emerged as the primary growth engine, particularly for non-game applications. This shift reflects broader industry changes where developers prioritize recurring revenue over one-time purchases or ad-based models.

Category Breakdown Shows Diverging Paths

Mobile games experienced the steepest decline, with downloads falling 8.6% to 39.4 billion. This follows a 6.6% drop in 2024, suggesting structural changes in gaming habits. By contrast, non-game apps saw downloads increase slightly by 1.1% to 67.4 billion, reversing the previous year's decline.

Revenue patterns mirrored this divergence:

- Non-game app spending jumped 33.9% to $82.6 billion

- Game spending grew modestly at 10% to $72.2 billion

- Non-game apps now represent 54% of total app spending

This marks a significant milestone where utility, productivity, and entertainment apps collectively outpace gaming revenue for the first time.

U.S. Market Reflects Global Trends

In the United States, consumer spending climbed 18.1% to $55.5 billion despite a 4.2% download decline to 10 billion. The non-game category drove this growth with a 26.8% spending increase ($33.6 billion), while game spending rose 6.8% ($21.9 billion).

Ecosystem Implications

The data underscores how subscription models have reshaped developer economics and user behavior:

- Revenue stability: Subscriptions provide predictable income streams, encouraging long-term app maintenance

- Feature development: Recurring revenue funds continuous improvements rather than major version upgrades

- User retention focus: Developers prioritize engagement over acquisition, leading to richer in-app experiences

- Platform lock-in: Services like iCloud integration and Apple One bundles increase subscription stickiness

While download declines may indicate market saturation in some categories, the revenue growth demonstrates users increasingly value ongoing utility over new app experimentation. This trend favors established developers with robust subscription offerings while challenging newcomers to demonstrate immediate value.

Appfigures' full report, when released, will provide additional insights into regional variations and category-specific performance. For developers, these results validate subscription models as essential for sustainable growth in today's mature app ecosystem.

Comments

Please log in or register to join the discussion