Lemonade, an AI-driven insurance provider, has launched a new Autonomous Car insurance product that halves premiums for miles driven with Tesla's Full Self-Driving (FSD) system active, based on Tesla's safety data showing a collision rate several times lower than the U.S. average.

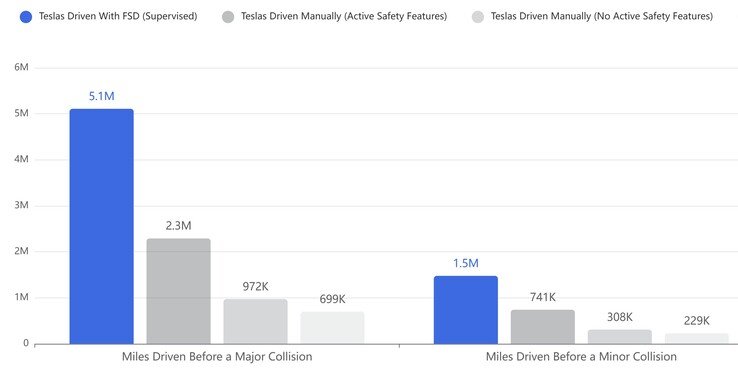

Tesla's Full Self-Driving (Supervised) system has long been a focal point of both technological advancement and safety debate. Now, the data behind its safety claims is translating into tangible financial benefits for drivers. According to Tesla's own Vehicle Safety Report, when FSD is engaged, the collision rate—both major and minor—is several times lower than the U.S. average. The company claims FSD results in seven times fewer collisions overall, or five times fewer off-highway incidents. This translates to one major collision every five million miles driven with FSD active, compared to the U.S. average of one collision every 699,000 miles for all vehicles, regardless of powertrain.

While the methodology of these claims has been disputed and the NHTSA is investigating accidents involving Tesla's driver-assist systems, insurers are beginning to act on the data. Lemonade, an AI-driven insurance provider, has launched what it calls a "first-of-its-kind product designed specifically for self-driving cars." The Autonomous Car insurance service uses Lemonade's AI-assisted data analysis, which concluded that accident rates are significantly lower when Tesla FSD is in control. As a result, Lemonade has halved its average insurance premium for any mile driven with FSD active.

Lemonade's existing pay-per-mile product provided the technological foundation for this new offering. The company states it has a "unique tech stack designed to collect massive amounts of real driving data for precise, dynamic pricing." For the Autonomous Car product, Lemonade collaborated directly with Tesla, gaining access to the latest, unannounced FSD safety data. This collaboration allows for a more accurate assessment of risk associated with autonomous driving.

This move marks a significant shift in the insurance industry's approach to autonomous vehicles. While Tesla has been attempting to reflect the safety benefits of FSD in its own insurance products, Lemonade is the first third-party insurer to launch a specific product that reduces premiums by 50% for FSD miles. This sets a precedent for how insurers might price risk as Level 2 and higher autonomous systems become more prevalent.

The timing and rollout are specific. The Lemonade Autonomous Car insurance option will be available starting January 26, first in Arizona and then in Oregon. Tesla drivers in these states will receive quotes for their new FSD-dependent premiums within seconds via the Tesla app or online. This rapid, data-driven quoting process is a hallmark of Lemonade's AI-centric model.

Looking ahead, the implications extend beyond current Tesla models. Tesla has plans for a driverless Cybercab, a vehicle without pedals or a steering wheel, which is slated to join its Robotaxi ride-share fleet later in 2026. The question remains whether Tesla will utilize Lemonade's insurance product for its own Robotaxi fleet, or if the company will develop its own insurance framework for fully autonomous operations. The success of Lemonade's product in the coming months could influence the broader insurance market's approach to fully autonomous vehicles.

The financial incentive provided by Lemonade directly addresses one of the key barriers to consumer adoption of driver-assist and autonomous technology: cost. By making insurance more affordable for FSD users, it creates a direct economic benefit that complements the safety and convenience arguments. This could accelerate the adoption of FSD among Tesla owners, potentially providing even more real-world data to refine the system further.

It's important to note that this insurance product is specifically for miles driven with FSD active. Traditional driving without the system engaged would likely be priced at standard rates. This creates a clear financial incentive to use the technology where it is safe and appropriate to do so.

The collaboration between Lemonade and Tesla also highlights the growing importance of data sharing in the automotive and insurance industries. As vehicles become more connected and autonomous, the data they generate becomes invaluable for risk assessment. Insurers that can effectively partner with automakers to access and analyze this data will have a significant advantage in developing new products and pricing models.

For Tesla drivers in Arizona and Oregon, the launch on January 26 represents a direct opportunity to lower their costs. The process is designed to be seamless, with quotes generated in seconds. This speed and efficiency are made possible by Lemonade's AI-driven platform, which can process vast amounts of driving data in real-time.

The broader trend is clear: as autonomous driving technology matures, the insurance industry is adapting. Products like Lemonade's Autonomous Car insurance are the first steps toward a new paradigm where risk is priced based on the actual performance of the driving system, not just the historical data of human drivers. This shift could eventually lead to more personalized and dynamic insurance models for all drivers, but it starts with the clear safety data provided by systems like Tesla's FSD.

In conclusion, the partnership between Lemonade and Tesla, resulting in a 50% premium reduction for FSD miles, is a concrete example of how data is reshaping traditional industries. It provides a financial reward for using advanced driver-assist systems and sets a template for future insurance products for fully autonomous vehicles. As the technology evolves and more data becomes available, we can expect further innovations in how we insure and price the risks associated with self-driving cars.

Comments

Please log in or register to join the discussion