Silicon Valley's AI frenzy masks a financial house of cards built on unprofitable models, ballooning debts, and stock manipulations that prioritize growth over reality. As hyperscalers and startups burn billions on GPU infrastructure with no clear path to profitability, this analysis exposes the interconnected vulnerabilities—from venture capital droughts to data center defaults—that threaten a bust worse than the dot-com era. The implications for developers and engineers are stark: a potential

The Enshittifinancial Crisis: AI's Hype Machine and the Looming Tech Finance Collapse

The tech industry's pivot to AI isn't just a technological shift—it's a financial gambit teetering on the edge of catastrophe. What began as a promise of transformative intelligence has devolved into the 'Enshittifinancial Crisis,' a fusion of Cory Doctorow's enshittification theory and the author's Rot Economy thesis. Platforms and markets alike degrade under relentless pressure for eternal growth, wasting trillions on speculative bets while real societal needs go unmet. For developers, engineers, and tech leaders, this means navigating a landscape where AI integrations drain resources without delivering value, all propped up by opaque accounting and hype-driven valuations.

This crisis echoes the dot-com bubble but amplified by AI's capital intensity. After 15 years of chasing scale over substance, companies now 'do AI' as a last-ditch hypergrowth ploy, even as products worsen and costs skyrocket. The money exists—$776 billion in hyperscaler capex over three years—but it's funneled to entities like private equity and VCs, not infrastructure or equity for the average person. Neoliberal incentives reward reckless gambles, creating a system where socialism aids the rich while the rest bootstrap through a 'free market' con.

Enshittification's Four Stages: From Platforms to Stocks

Doctorow outlines three phases: platforms lure users with free, seamless experiences; consolidate power to favor advertisers, eroding usability; and finally extract maximum value, turning everything to 'shit' for owners' gain. Meta embodies this—Facebook and Instagram, acquired to stifle competition, now flood feeds with AI slop, clickbait, and divisive algorithms to sustain $ billions in ads. Businesses suffer too: campaigns misfire, outages wipe 70% of revenue, and tools stealthily replace ads with AI-generated oddities, like targeting 30–45-year-old men with a grandma avatar.

The stock market enters stage four, abusing even shareholders. Valuations detach from health—Meta projects $16 billion from scams yet analysts hike targets to $920, ignoring $70 billion capex on revenue-less AI. Tricks abound: extending server lives from 3 to 6 years saves Meta $2.3 billion in depreciation; off-balance-sheet data centers hide debts. Analysts, media, and investors—trained on a decade of 'number go up'—shrug, echoing dot-com pumpers who hyped Winstar's $2 billion deal for $100 million revenue.

Enshittification unfolds... third, the company turns the user experience into 'a giant pile of shit,' making the platform worse for users and businesses alike in order to further enrich the company’s owners and executives. — Cory Doctorow, via The New Yorker

Incentives stifle scrutiny: sell-side analysts risk fees on bearish calls; journalists chase access over truth. Stocks become casino chips, manipulated via AI announcements that spike prices then fizzle.

AI Accelerates the Rot: Hype Over Substance

AI isn't saving tech—it's inflating a Rot Com bubble. Hyperscalers' capex—Microsoft's $34.9 billion, Amazon's $34.2 billion—supposedly buys GPUs, but NVIDIA's revenue (four customers at 61%) misaligns. Modeling reveals Microsoft's 1.11GW build in nine months, yet power shortages idle chips. Opaque spends—leases, untracked opex—yield no insight into returns.

'Partnerships' fuel surges: Oracle's $300 billion OpenAI LOI jumps stock 30%, analysts swoon 'momentous' sans funding checks. NVIDIA's $100 billion 'intent' with OpenAI? Non-binding, no cash flowed. AMD's 6GW 'definitive' deal? Zero revenue in filings. Broadcom's 10GW? CEO confirms no orders. Media amplifies; skeptics buried. Stocks yo-yo, torching traders.

// Visualization of capex vs. NVIDIA revenue concentration, highlighting misalignment

// Visualization of capex vs. NVIDIA revenue concentration, highlighting misalignment

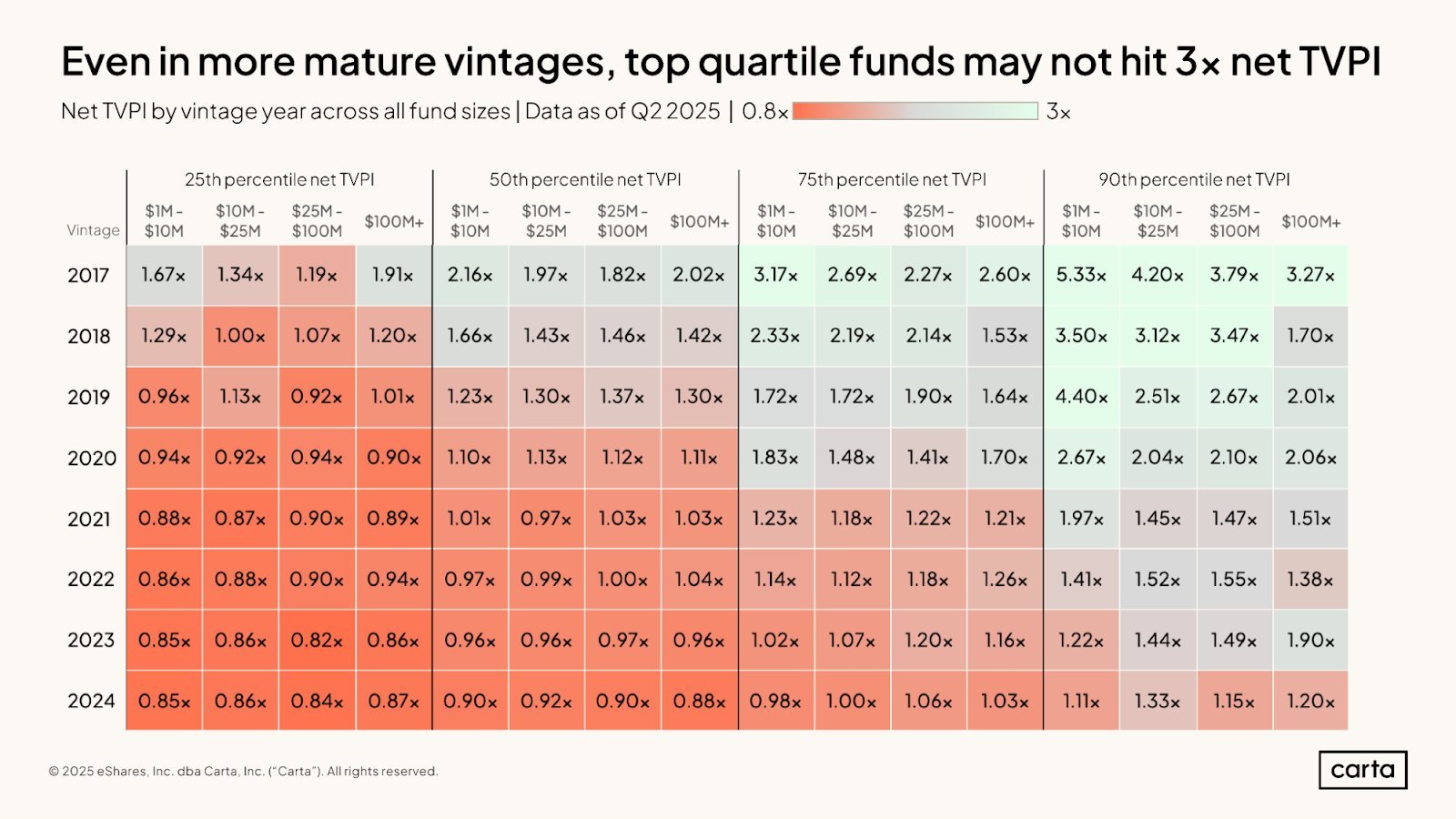

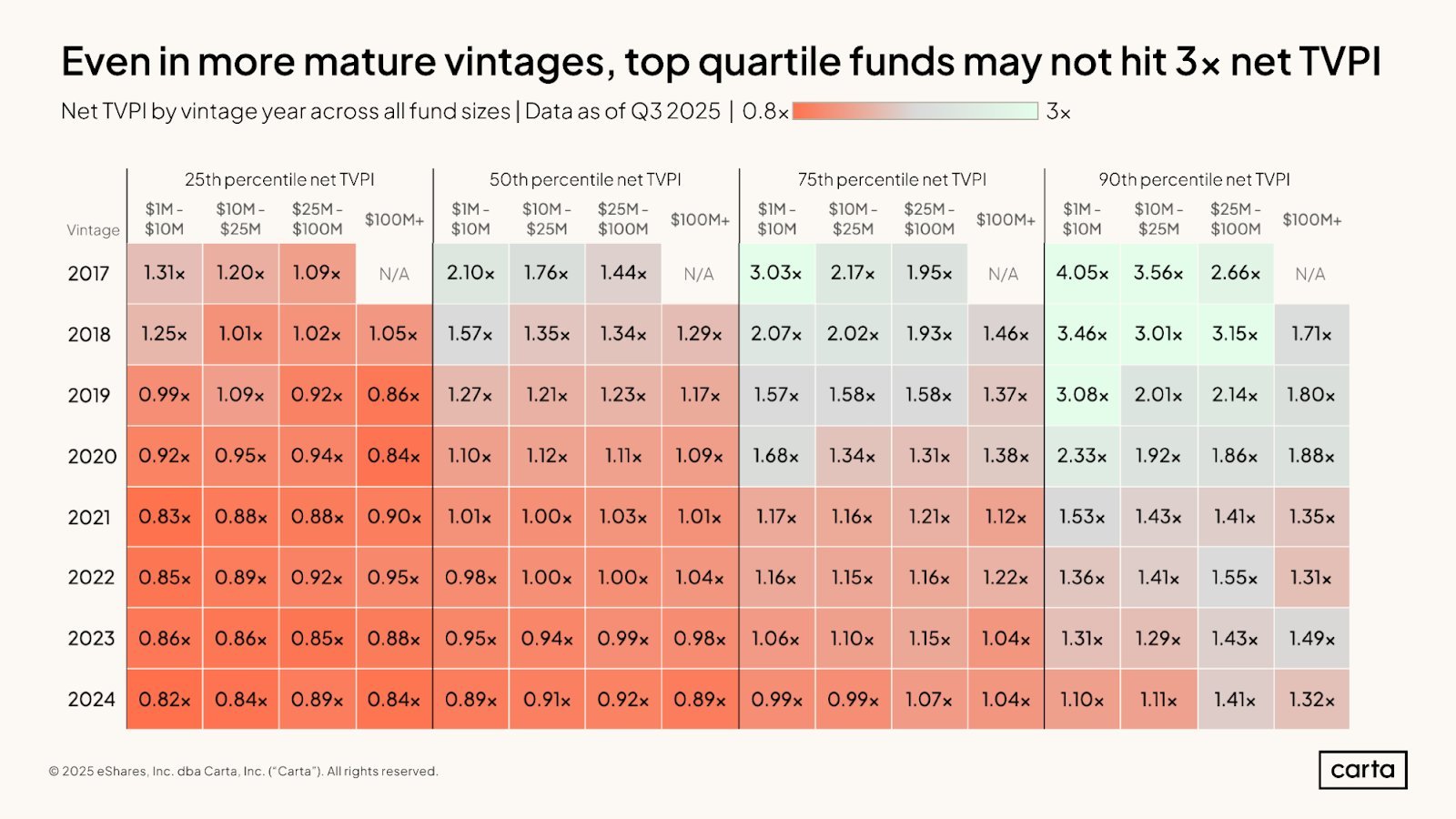

VCs fare worse: AI startups (Cursor: $2.3B raised on $83M revenue) prompt OpenAI/Anthropic models, unacquirable, un-IPOable. Valuations balloon—OpenAI $830B—juicing AUM fees, but liquidity craters: 10% of 2021 funds distributed, TVPI 0.8–2x. Secondaries hit $122B, but it's equity shuffling. 51% of 2025 VC in AI demands endless capital for negative margins.

Data Centers: The Debt-Fueled Ticking Bomb

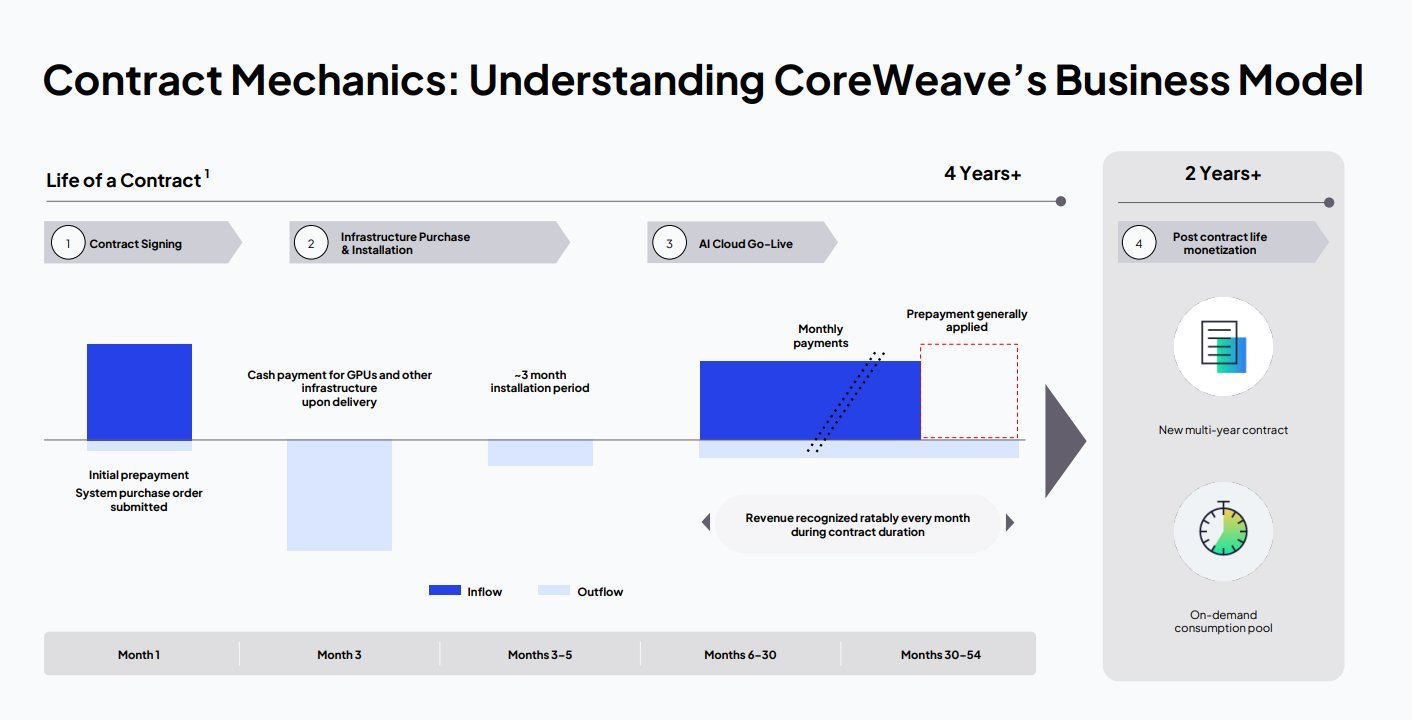

$178.5B in 2025 data center credit rivals VC, but neoclouds like CoreWeave ($25B debt, $5.35B revenue) exemplify peril: sign contracts ($22.4B OpenAI), debt-collateralize, buy/install GPUs (6–12 months), build (1–3 years, delays galore), lose on rentals. Deferred revenue: $1.1B; net-360 terms delay OpenAI pays a year. NVIDIA backs $860M leases.

Financing clusters: MUFG/JP Morgan/Morgan Stanley in 17+ deals, 24 back CoreWeave. Stargate ($38B Oracle, $18B NM) involves same players. Cracks: Blue Owl exits Michigan over debt; banks hedge SRTs. Delays (Core Scientific's rainy 260MW) compound. By 2027, Blackwell obsolete for Kyber racks, devaluing amid oversupply.

// Flowchart of data center debt chain, from contracts to obsolescence

// Flowchart of data center debt chain, from contracts to obsolescence

Demand? OpenAI/Anthropic ($11.33B spend) dominate, but $4.5B revenue can't cover. NVIDIA's $26B cloud commitments? Self-subsidy. Broader compute: <$1B sans hyperscalers. Blackwell rentals: $4.41/hour, falling.

// Line graph of GPU rental price decline amid supply flood

// Line graph of GPU rental price decline amid supply flood

The Chain of Pain: Interlinked Vulnerabilities

NVIDIA sells debt-bought GPUs to centers losing on unprofitable labs (OpenAI/Anthropic burn billions); labs subsidize startups via VC; all hyped by enshittified stocks. Break one link—delays, VC drought, defaults—cascades. NVIDIA's diversified revenue plunges ($30.84B to $22.23B), signaling squeezes.

If burst: VC AI holdings to zero; data centers idle; banks default (PE fraud like First Brands spills). Discount Window upticks signal liquidity woes.

For devs/engineers: AI's unreliability—inconsistent outputs, high costs—wastes integration efforts. True innovation demands proving value, not subsidizing hype.

The Rot ends not in triumph, but reckoning—recalibrating tech toward sustainable, problem-solving engineering over growth's illusion.

Source: Based on Ed Zitron's in-depth investigation at Where's Your Éd At?, incorporating SEC filings, PitchBook/Carta data, and financial analyses.

// Hero image: Fractured circuits symbolizing tech's financial unraveling

// Hero image: Fractured circuits symbolizing tech's financial unraveling

// Supplemental chart: VC TVPI trends showing liquidity stagnation

// Supplemental chart: VC TVPI trends showing liquidity stagnation

Comments

Please log in or register to join the discussion