New data reveals a fundamental split in the AI market: Proprietary models command premium pricing for mission-critical tasks despite open-source alternatives being 10-100x cheaper. While programming emerges as the dominant enterprise use case, cost-sensitive consumers flock to open-source roleplaying models—creating parallel ecosystems with distinct economics.

)

DeepSeek's open-source dominance peaked at 80% but has since halved amid rising competition. (Source: OpenRouter State of AI Report 2025)

)

DeepSeek's open-source dominance peaked at 80% but has since halved amid rising competition. (Source: OpenRouter State of AI Report 2025)

Despite open-source AI models offering staggering cost advantages—often 10-100x cheaper than proprietary counterparts—new market analysis reveals established providers like OpenAI, Anthropic, and Google retain formidable pricing power. Data from OpenRouter's 2025 State of AI Report paints a picture of a bifurcated market where economic logic diverges sharply between enterprise and consumer applications.

The Pricing Paradox Explained

Open-source models have maintained a stable 22-25% market share throughout 2025, briefly spiking to 35% during a surge of Chinese model adoption mid-year. This stability persists despite massive cost differentials, exposing weak price elasticity in core enterprise segments. As the report notes: "Proprietary providers retain pricing power for mission-critical applications, while open ecosystems absorb volume from cost-sensitive users."

Market Dynamics: The Rise of Chinese Models & Use Case Specialization

The open-source landscape has undergone dramatic shifts. DeepSeek, which commanded nearly 80% of OSS market share in early 2025, has seen its dominance halved to around 40% as models like Qwen gain traction. Concurrently, clear product-market fit has emerged:

- Programming dominates enterprise workflows: Coding accounts for 60% of Anthropic’s usage, 45% of xAI’s, and remains a top-2 use case for every major provider except DeepSeek.

- Roleplaying fuels consumer growth: DeepSeek’s 80% roleplay usage illustrates how cost sensitivity shapes entertainment-focused adoption.

- Scientific niche endures: OpenAI maintains a 20% science-focused user base—a legacy of early academic adoption.

| Provider | #1 Use Case | % | #2 Use Case | % |

|---|---|---|---|---|

| Anthropic | Programming | 60% | Roleplay | 10% |

| xAI | Programming | 45% | Technology | 15% |

| Qwen | Programming | 27% | Roleplay | 18% |

| Roleplay | 25% | Programming | 20% | |

| OpenAI | Programming | 22% | Science | 20% |

| DeepSeek | Roleplay | 80% | Programming | 5% |

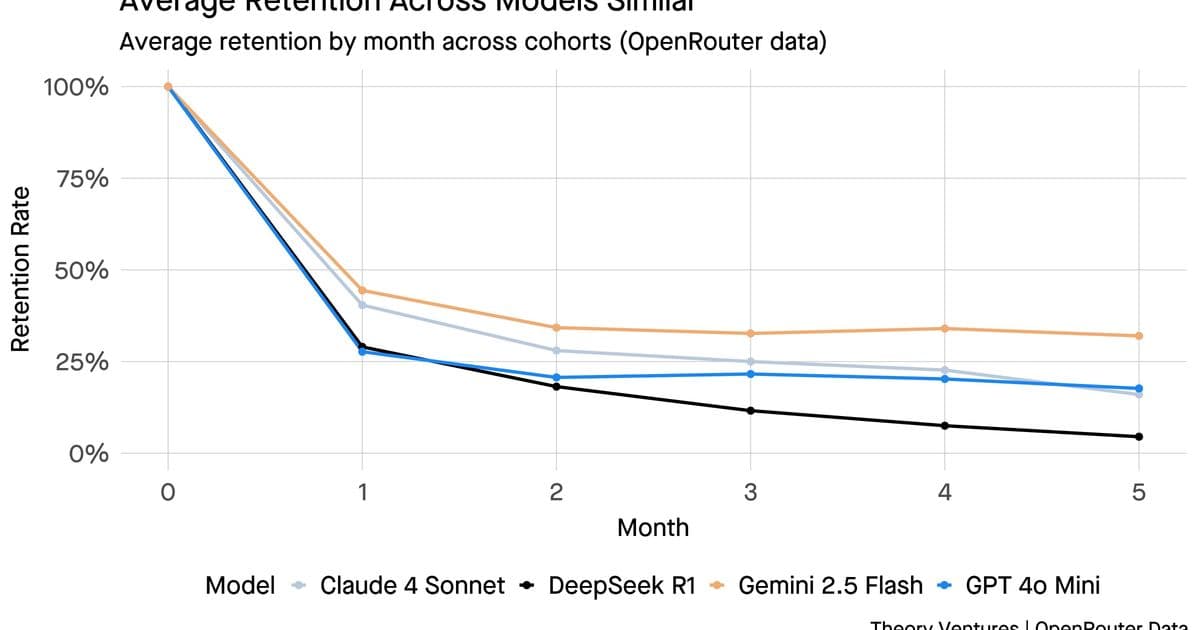

Retention Reveals Workflow Stickiness

)

Claude 4 Sonnet and Gemini 2.5 Flash show significantly stronger retention than competitors. (Source: OpenRouter State of AI Report 2025)

)

Claude 4 Sonnet and Gemini 2.5 Flash show significantly stronger retention than competitors. (Source: OpenRouter State of AI Report 2025)

Retention metrics underscore the specialization trend. While most models lose 60-70% of users within the first month, Anthropic’s Claude 4 Sonnet and Google’s Gemini 2.5 Flash achieve 40-50% Month 1 retention—far exceeding GPT-4o Mini and DeepSeek R1 (25-35%). This suggests models deeply embedded in professional workflows (like coding) develop stronger user loyalty than those used for transient entertainment.

The data ultimately reveals a market segmented by willingness-to-pay: Enterprises prioritize precision and reliability for critical tasks like software development, insulating premium providers from price competition. Meanwhile, open-source models capture volume-driven, cost-sensitive segments like roleplay—a divergence ensuring both ecosystems thrive but under fundamentally different economic rules.

Data Source: OpenRouter State of AI Report (2025). Analysis based on November 2025 usage data. Original Report: Tom Tunguz - OpenRouter Insights

Comments

Please log in or register to join the discussion