A political proposal to cap credit card interest rates at 10% could save U.S. consumers billions annually but risks disrupting bank profitability and credit access.

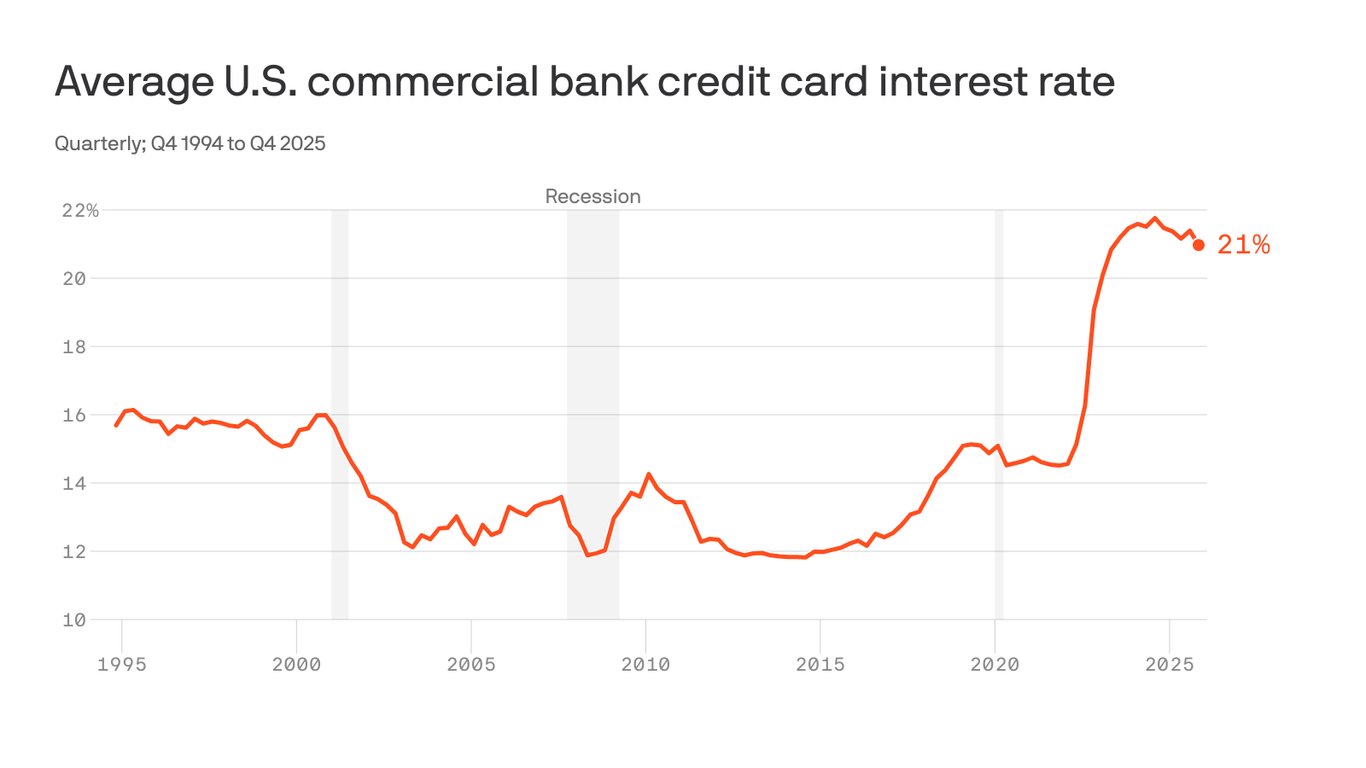

Former President Donald Trump's recent campaign pledge to cap credit card interest rates at 10% represents a seismic shift in consumer finance policy. With average credit card APRs currently at record highs of 21-22% (Federal Reserve data), the proposal targets America's $1.08 trillion in revolving credit debt (New York Fed).

Financial impact analysis shows:

- Consumer savings potential: At current debt levels, a 10% rate cap would reduce annual interest payments by approximately $120 billion based on average APR reductions. Households carrying the median credit card balance of $6,501 would save roughly $780 annually.

- Banking sector exposure: Major issuers like JPMorgan Chase and Citigroup derive 28-35% of card division revenue from interest income. A 10% cap could erase $68 billion in annual industry revenue according to Consumer Financial Protection Bureau (CFPB) fee models.

- Credit access trade-offs: Historical data from the 1980s usury cap era suggests approval rates for subprime borrowers could drop 15-20% as banks compensate for lost revenue. Analysis of similar regulations in Australia shows increased annual fees (+22%) and reduced rewards programs.

Market implications: Payment processors like Visa and Mastercard face downstream effects through reduced transaction volumes if consumer spending contracts due to credit tightening. Securitized credit card debt—a $150 billion market—would require restructuring, potentially increasing bond yields. Fintech lenders using algorithm-driven pricing may gain market share from traditional banks constrained by the cap.

The proposal faces implementation hurdles including potential preemption by federal banking laws. While consumer savings are substantial, the policy could accelerate industry consolidation among smaller issuers and shift borrowing toward unregulated payday lenders—a pattern observed after the 2009 CARD Act's fee restrictions. Regulatory impact studies suggest a phased implementation over 36 months would mitigate systemic risk compared to immediate enactment.

Comments

Please log in or register to join the discussion