Taiwan Semiconductor Manufacturing Company will produce 3-nanometer semiconductors for AI applications at its second Japanese plant in Kumamoto, marking a strategic advancement in Japan's semiconductor ambitions.

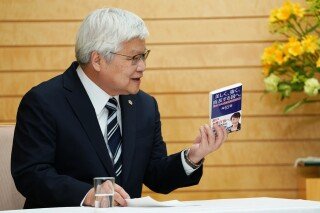

Taiwan Semiconductor Manufacturing Company (TSMC) has committed to manufacturing its most advanced 3-nanometer semiconductors in Japan, accelerating the country's push to regain prominence in global chip production. The world's largest contract chipmaker confirmed plans during a meeting between TSMC Chairman C.C. Wei and Japanese Prime Minister Sanae Takaichi in Tokyo on February 5, 2026.

The decision positions TSMC's second Kumamoto facility – currently under construction – as a production hub for chips powering artificial intelligence systems, robotics, and autonomous vehicles. These 3nm components represent TSMC's most sophisticated process node, offering significant improvements in power efficiency and computing density compared to previous generations. The Kumamoto expansion complements TSMC's existing Japanese plant that began mass-producing less advanced chips in late 2024.

Japan's government has actively courted semiconductor investment through substantial subsidies and policy support, viewing advanced chip manufacturing as critical for economic security. Prime Minister Takaichi emphasized this during the announcement, stating: "It is very meaningful from the perspective of Japanese economic security, and I would like the project to move forward as proposed." The timing precedes Japan's general election, where technology sovereignty remains a central policy platform.

TSMC's investment aligns with Japan's parallel backing of domestic chipmaker Rapidus, which is developing next-generation semiconductor technology with government support. Wei acknowledged Japan's strategic approach, noting in an official statement that the country's "forward-looking semiconductor policy will deliver significant benefits to the semiconductor industry."

The expansion responds to surging demand for AI-optimized hardware. TSMC recently announced plans to increase capital spending by up to 40% in 2026, projecting investments between $52-$56 billion compared to $40 billion in 2025. This aggressive scaling follows sustained orders from AI sector clients like Nvidia, whose processors rely on TSMC's advanced nodes. Despite market concerns about potential AI investment bubbles, Wei maintains that current demand reflects genuine industry needs.

Japan's Kumamoto facility will operate alongside TSMC's new Arizona plants, creating a geographically diversified manufacturing network. This multi-country approach mitigates supply chain risks while positioning TSMC to capture growth across key AI markets. For Japan, securing 3nm production represents a milestone in rebuilding its semiconductor ecosystem after decades of diminished global market share.

Official details on TSMC's Kumamoto expansion timeline and production volumes remain undisclosed. The company's corporate website provides updates on its global manufacturing capabilities.

Comments

Please log in or register to join the discussion