China's massive AI computing clusters, now exceeding 1,590 exaflops across 42 facilities, are forcing rapid adoption of liquid cooling technologies as air cooling fails to handle processors exceeding 1,000 watts.

China's national AI infrastructure initiative has reached a thermal tipping point. According to the Ministry of Industry and Information Technology, the country now operates 42 intelligent computing clusters each containing 10,000+ accelerator cards, with total computational capacity surpassing 1,590 exaflops. These dense installations, concentrated in western provinces under Beijing's "Eastern Data, Western Computing" strategy, house processors like Nvidia's 1,000W+ B200 GPUs that overwhelm conventional air-cooling systems.

Technical Imperatives

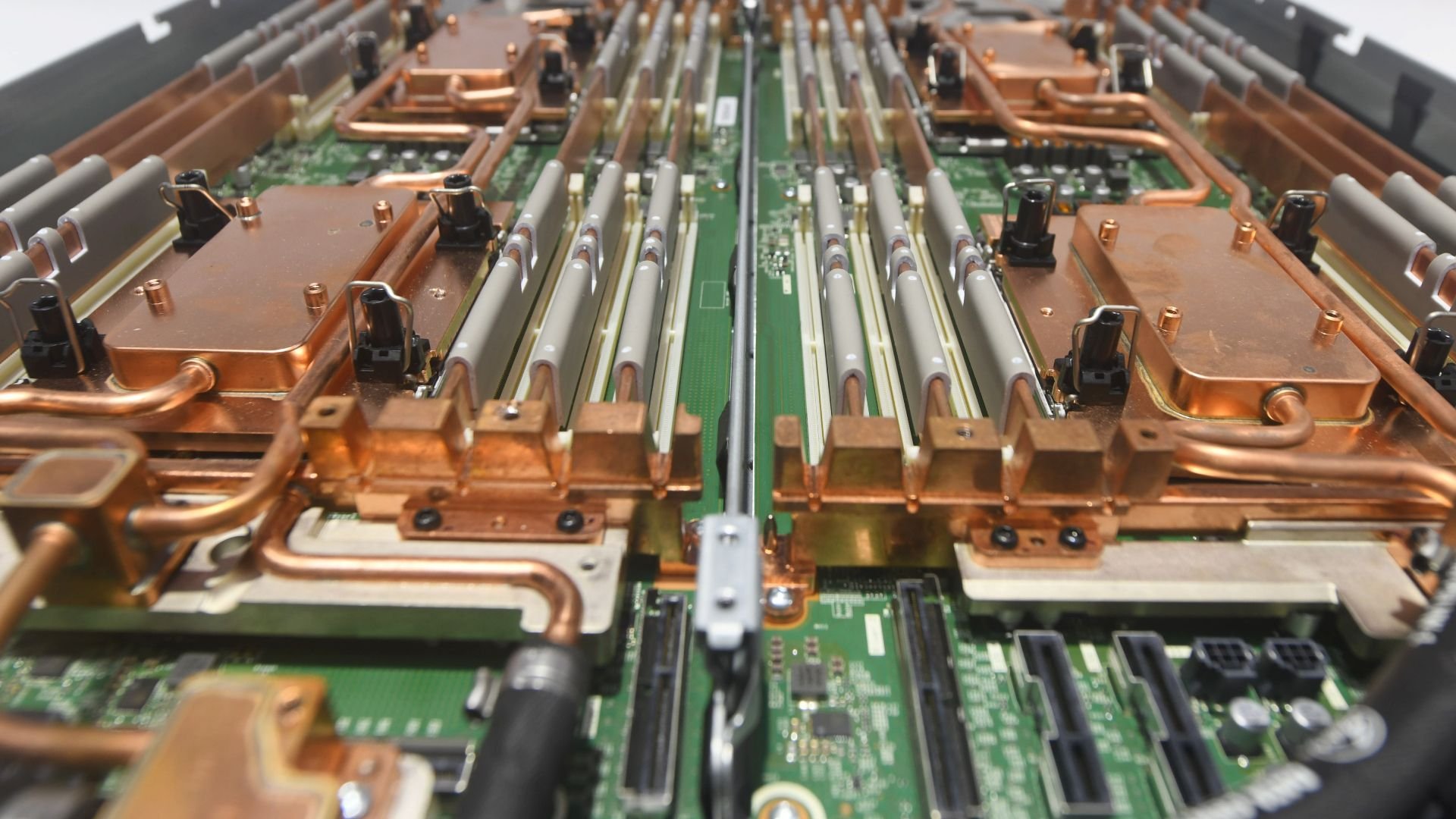

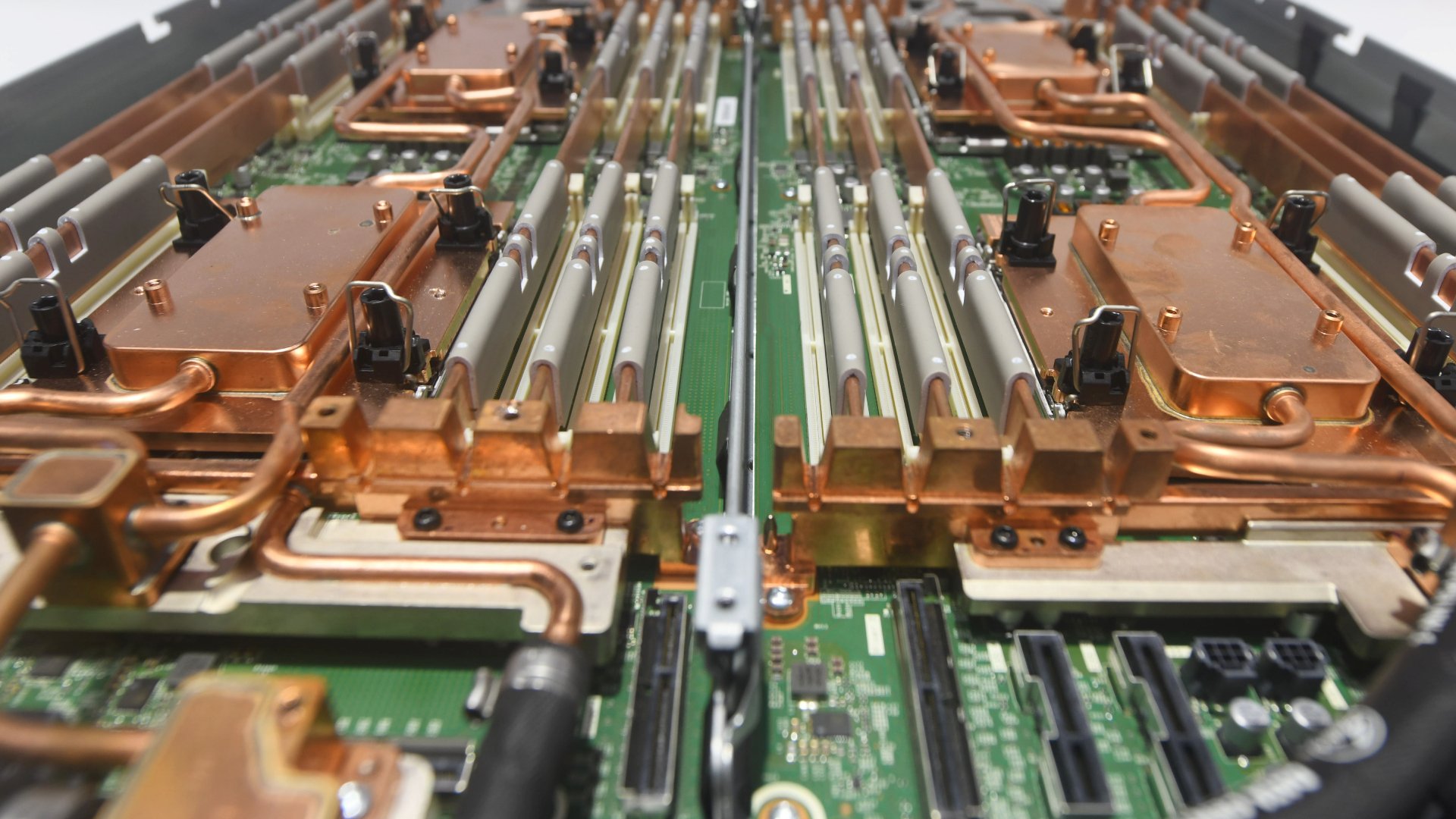

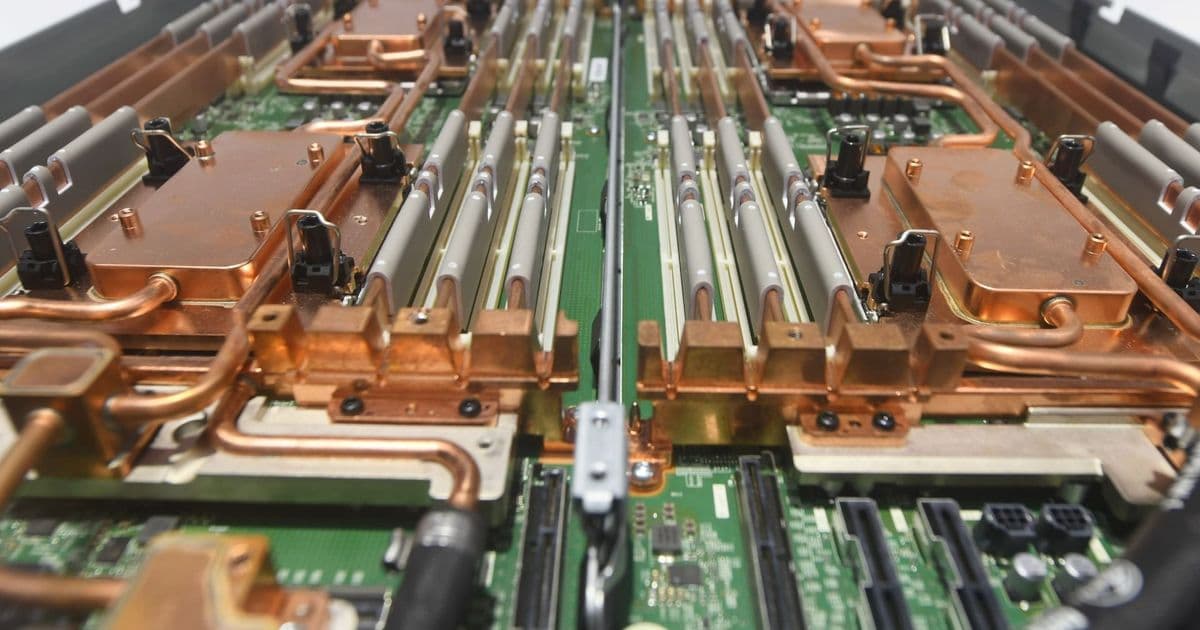

Air cooling faces fundamental limitations at these power densities. The volumetric heat capacity of air restricts thermal transfer efficiency, requiring impractical airflow volumes at multi-kilowatt rack densities. By comparison, liquid cooling provides 3,500x greater heat transfer capacity than air. Modern implementations include:

- Direct-to-chip cold plates circulating coolant within millimeters of processors

- Immersion tanks submerging entire server racks in dielectric fluid

- Spray cooling systems targeting hotspots

These systems reduce cooling energy consumption by 30-50% while enabling rack densities impossible with air. The thermal advantage becomes critical in China's GB200 NVL72 racks containing 72 GPUs and 36 CPUs - configurations that ship exclusively with liquid cooling solutions.

Market Transformation

Domestic suppliers are scrambling to meet demand. Envicool, whose stock tripled in the past year, supplies liquid cooling infrastructure to Alibaba, Tencent, and Nvidia. Financial institutions including Goldman Sachs and UBS have raised price targets citing projected 40% annual growth in China's liquid cooling market through 2027. The shift aligns with national power usage effectiveness (PUE) mandates requiring data centers to maintain ratios below 1.3 - an impossible target for air-cooled AI racks.

Global players like Vertiv ($13.5B annual revenue) dominate the cooling distribution unit and cold plate markets, but Chinese manufacturers are rapidly localizing supply chains. This acceleration avoids export-controlled components while supporting western provinces where greenfield data centers can design liquid cooling infrastructure natively rather than retrofitting existing facilities.

Performance Implications

The thermal transition isn't optional. Training clusters running thousands of accelerators experience performance degradation from temperature variations across racks, impacting clock speeds and error rates. With AI model sizes increasing exponentially, liquid cooling's thermal stability provides reliability advantages beyond efficiency. Analysts project liquid cooling will become standard for all >10kW racks by 2026, potentially reducing China's AI cluster cooling energy consumption by 25% while enabling next-generation 1,500W+ processors.

Luke James covers semiconductor infrastructure and energy efficiency.

Comments

Please log in or register to join the discussion