China deployed 174 gigawatt-hours of new battery storage capacity in 2025, more than triple North America's installations, with projections indicating this gap will further widen in 2026 despite surging U.S. demand driven by AI infrastructure.

China solidified its leadership in the global energy storage market in 2025, deploying 174.19 gigawatt-hours (GWh) of new battery storage capacity according to industry data. This represents a 47% year-over-year increase and exceeds North America's installations by more than threefold. Analysts project this gap will expand further throughout 2026, even as artificial intelligence-driven power demands accelerate storage adoption in the United States.

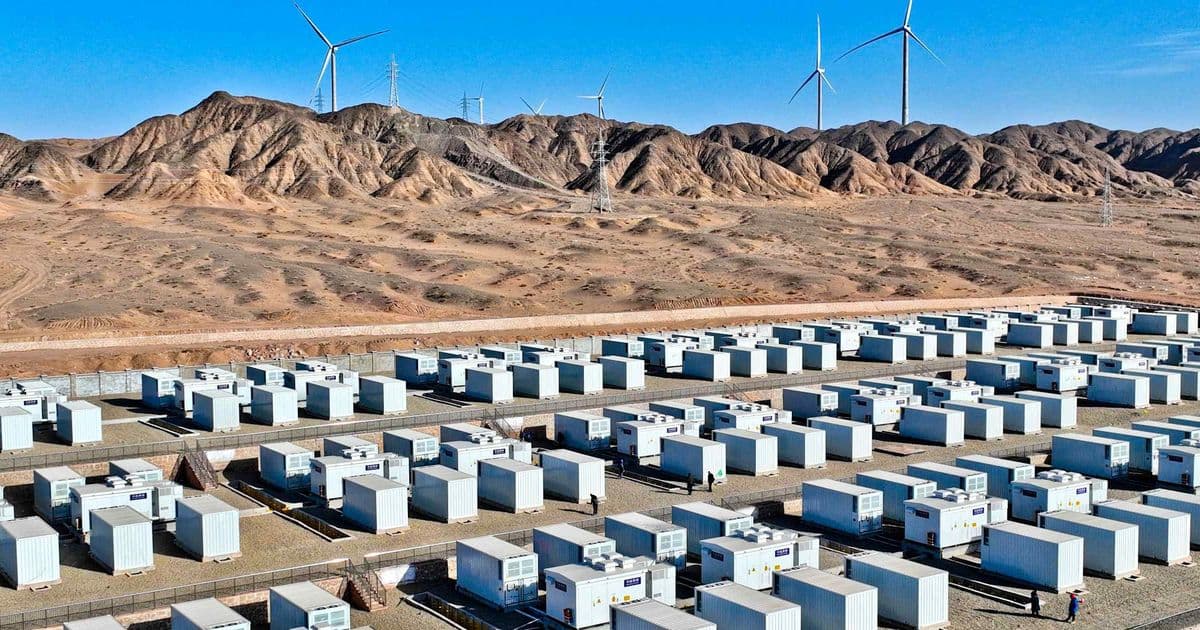

China's storage boom stems from aggressive government mandates requiring renewable energy projects to incorporate storage capacity. Provincial regulations now mandate 10-20% storage integration for new solar and wind installations. Simultaneously, manufacturing scale provides decisive cost advantages: Chinese lithium iron phosphate (LFP) battery cell production costs average $72/kWh compared to $95/kWh in North America. This economic edge enabled deployments like the 1.2 GWh project in Gansu Province, part of a nationwide buildout supporting grid stability amid record renewable generation.

North America installed approximately 55 GWh in 2025—a 35% annual increase largely fueled by data center backup power needs. Major tech companies including Amazon, Microsoft, and Google are procuring grid-scale storage to support AI data processing facilities, which require uninterrupted power for high-density computing loads. However, interconnection queue delays averaging 4.7 years and domestic content requirements under the Inflation Reduction Act slowed deployment velocity. Supply chain diversification efforts—shifting from Chinese to South Korean battery suppliers—also increased procurement complexity.

The widening installation gap carries strategic implications. Chinese storage manufacturers CATL and BYD now control 63% of global grid-scale battery supply, leveraging economies of scale to undercut international competitors. Energy analysts note China's storage buildout enables higher renewable penetration rates, potentially reducing coal dependence by 11% in high-solar regions by 2030. Meanwhile, U.S. utilities face rising curtailment costs—estimated at $2.6 billion annually—as storage shortages prevent optimal renewable utilization during peak generation periods.

Market projections indicate China will deploy over 230 GWh in 2026, compared to North America's expected 75 GWh. This divergence persists despite forecasted 52% growth in U.S. deployments, highlighting structural advantages in China's policy-manufacturing ecosystem. Industry observers suggest accelerated domestic cathode production and streamlined permitting could narrow the gap long-term, but near-term leadership remains firmly with Chinese players capitalizing on integrated supply chains and regulatory tailwinds.

Comments

Please log in or register to join the discussion