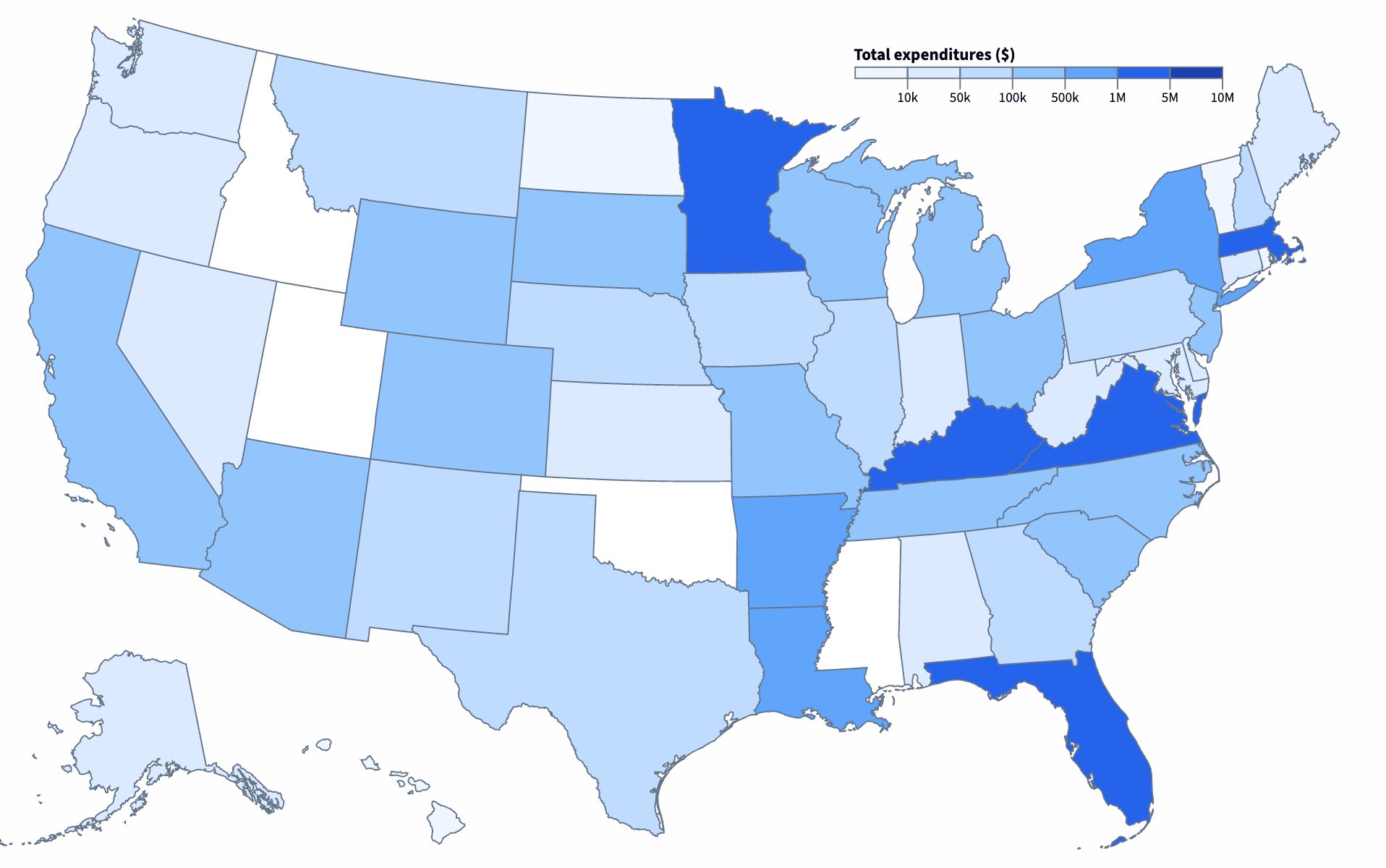

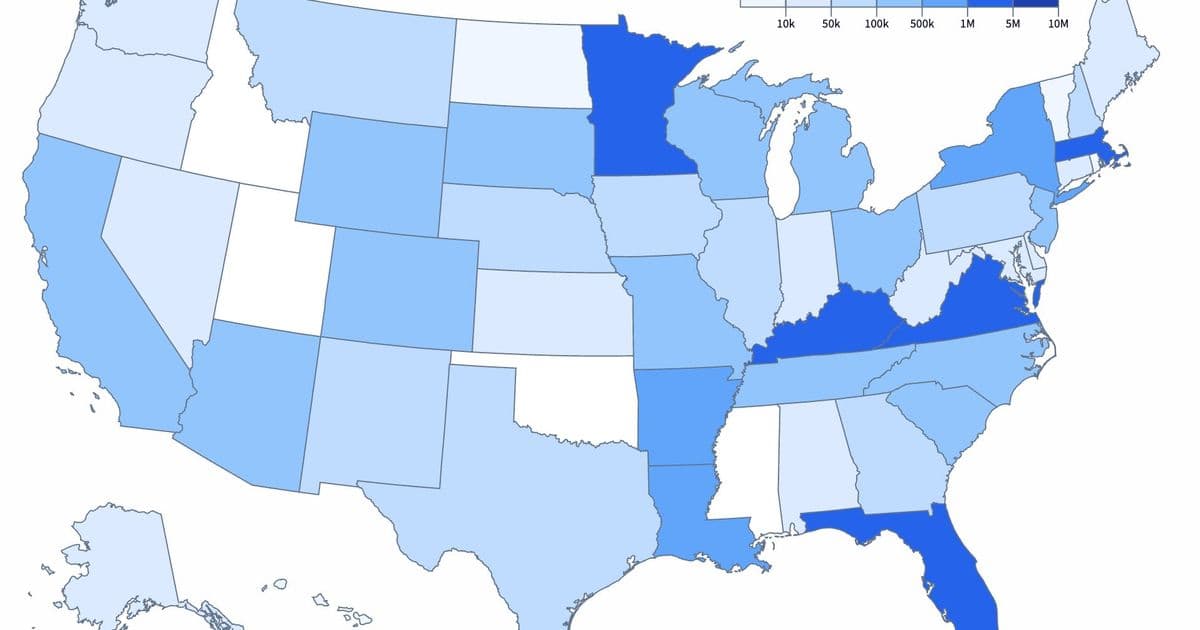

Cryptocurrency-backed PACs have contributed over $288 million to influence the 2026 U.S. midterm elections, more than double the 2024 cycle, with Fairshake becoming America's fifth most-funded PAC.

The cryptocurrency industry has deployed at least $288 million in political contributions toward the 2026 U.S. midterm elections, according to an analysis by Molly White published on Citation Needed. This represents a more than twofold increase over total spending during the 2024 election cycle and positions crypto-backed political action committee Fairshake as the nation's fifth most-funded PAC.

White's analysis suggests this spending surge coincides with two key developments: diminished political momentum for former President Donald Trump (who previously positioned himself as pro-crypto) and the industry's failure to achieve comprehensive regulatory frameworks despite significant lobbying efforts. Fairshake, funded primarily by major cryptocurrency exchanges, venture capital firms, and blockchain companies, has become the primary conduit for this political expenditure.

This level of financial commitment places Fairshake among traditional political heavyweights, surpassing many established industry PACs. According to Federal Election Commission data analyzed by White, Fairshake's funding sources include:

- Major cryptocurrency exchanges (Coinbase, Binance.US)

- Venture capital firms with significant crypto investments (Andreessen Horowitz, Paradigm)

- Blockchain infrastructure companies

- Crypto founders and executives

The spending pattern reveals a strategic shift toward influencing congressional races and state-level elections where crypto regulation is being debated. Unlike traditional industry PACs that typically favor incumbents, Fairshake has funded both Democratic and Republican candidates who support industry-friendly legislation like the failed FIT21 Act, which sought to establish clearer digital asset regulations.

Three factors appear to be driving this unprecedented spending:

- Regulatory gaps: Despite years of lobbying, core issues like stablecoin oversight and exchange regulations remain unresolved

- Enforcement actions: Ongoing SEC lawsuits against major exchanges create operational uncertainty

- Competing frameworks: State-level regulatory approaches (like New York's BitLicense) create compliance complexity

Critics argue this spending represents an attempt by a volatile industry to buy political influence before establishing adequate consumer protections. "The scale is notable," White observes, "especially for an industry still grappling with fundamental questions about its societal value and stability." The $288 million figure doesn't include indirect contributions or dark money channels, suggesting actual influence efforts may be significantly higher.

With midterm elections still months away, this financial commitment demonstrates the cryptocurrency industry's transition from technological disruption to political player – willing to spend aggressively to shape regulatory outcomes despite ongoing market volatility and incomplete policy victories.

Comments

Please log in or register to join the discussion