Intel reaffirms commitment to consumer CPUs despite wafer shortages shifting focus to data center demand, with Nova Lake on track for late 2026 and 14A process arriving in 2028 amid ongoing yield challenges.

Intel's Q4 2025 earnings reveal strategic wafer allocation tensions as the company navigates competing demands between its data center ambitions and client computing commitments. Despite shifting internal wafer production toward Data Center and AI (DCAI) products, CFO David Zinsner explicitly stated: "We're shifting as much as we can over to the data center... we can't completely vacate the client market." This declaration comes amid industry-wide shortages, with CEO Lip-Bu Tan noting "memory constraints and pricing" as critical challenges affecting overall capacity planning.

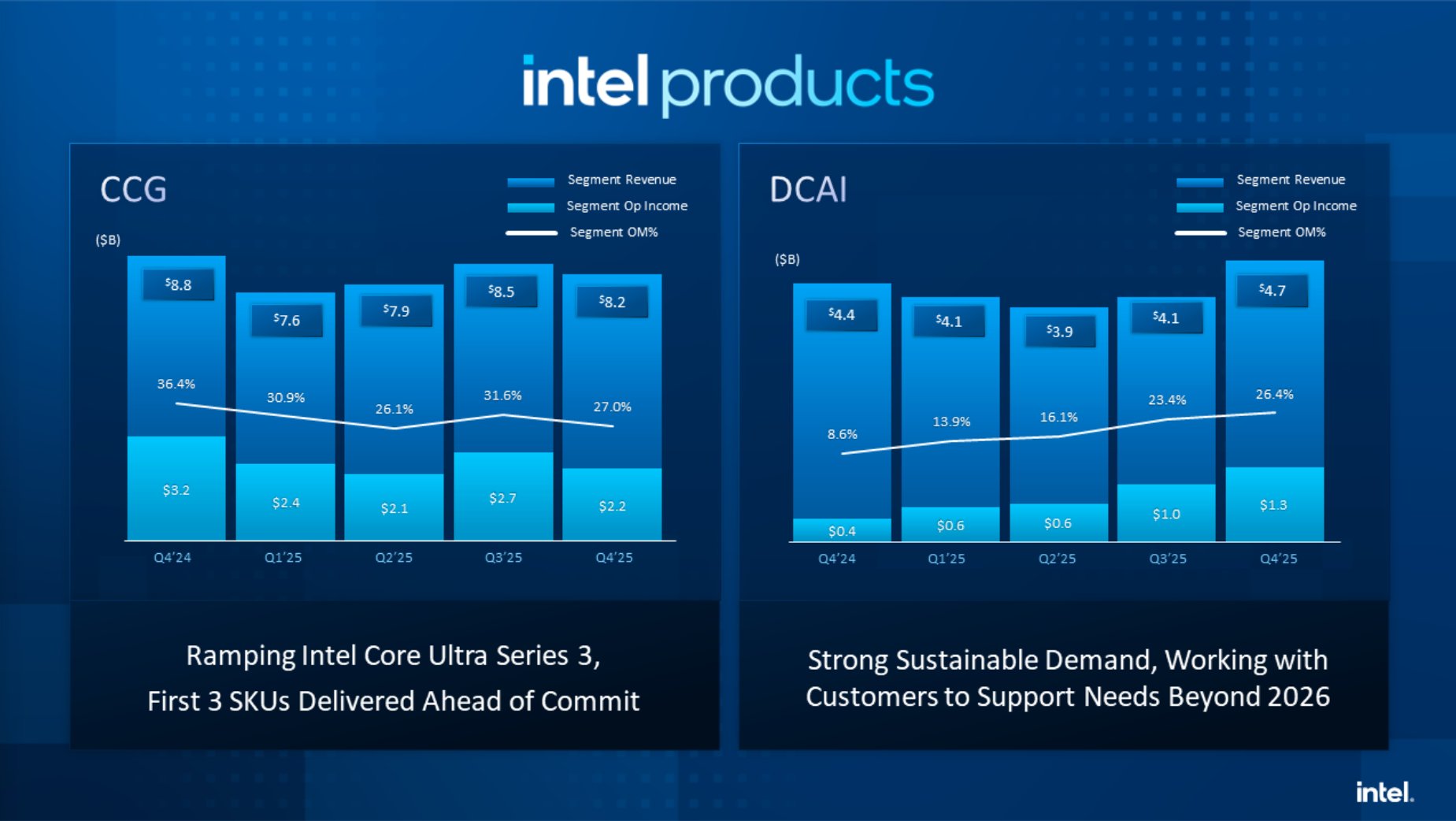

Current client offerings remain prioritized despite constraints. Panther Lake processors (marketed as Core Ultra Series 3) maintain their January 27 launch date, though Tan acknowledged "client CPU inventory is lean" and warned that "rising component pricing could limit our client opportunity this year." This supply-demand imbalance creates near-term revenue pressure, with Intel's Client Compute Group (CCG) posting Q4 revenue of $8.2 billion – a 7% year-over-year decline contributing to CCG's full-year 2025 revenue drop of 3%.

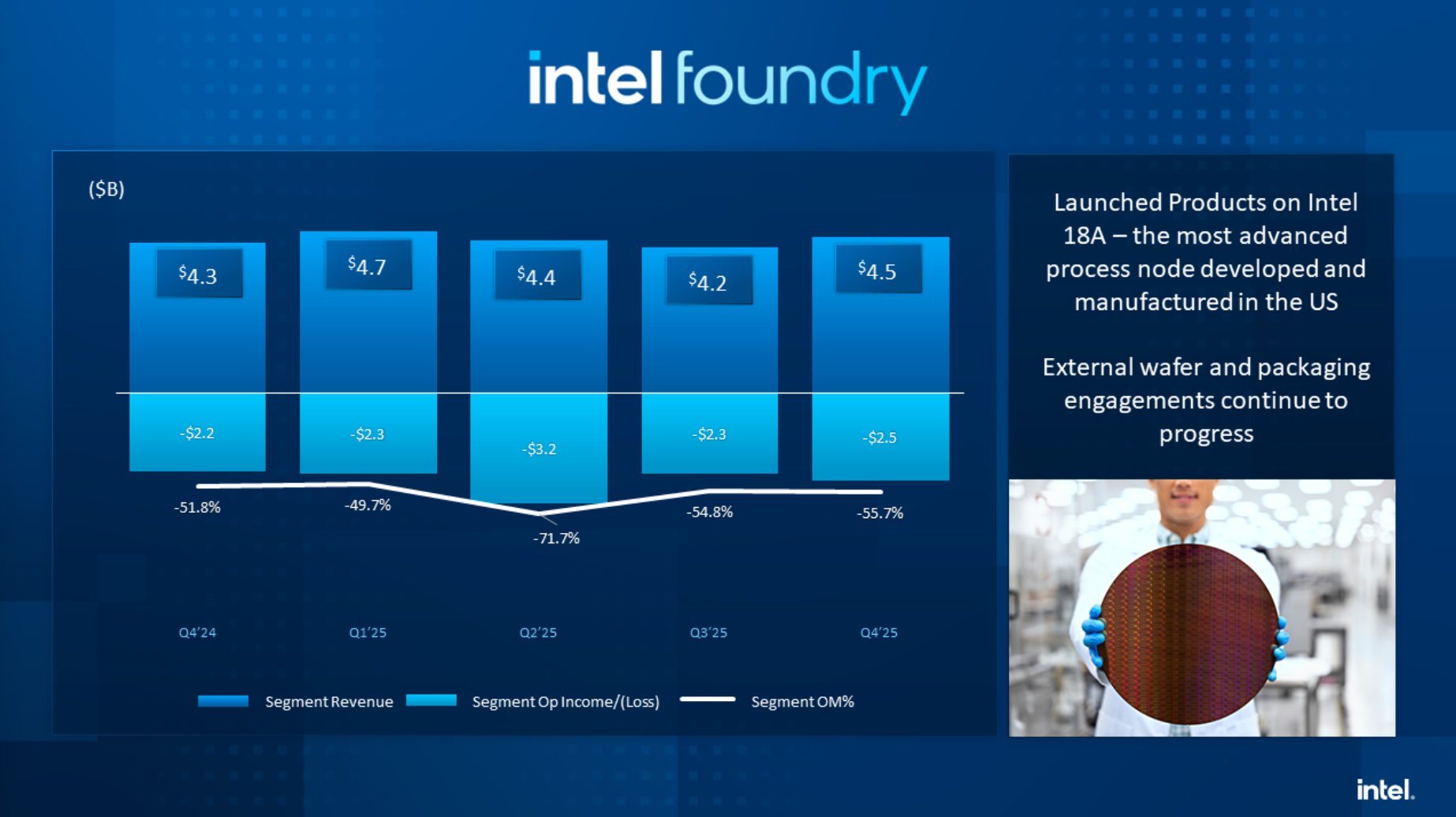

On the architectural roadmap, Tan confirmed Nova Lake's desktop CPUs remain on schedule for late 2026. As Intel's first desktop implementation using the 18A process node, Nova Lake will directly compete with AMD's anticipated Zen 6 architecture. The subsequent 14A node progresses toward risk production in late 2027 with full production slated for 2028. While Intel has achieved initial 18A shipments, yield improvement remains critical. "Yields are in-line with our internal plans, [but] they're still below where I want them to be," Tan admitted, detailing a monthly yield improvement target of 7-8% to reduce per-unit costs.

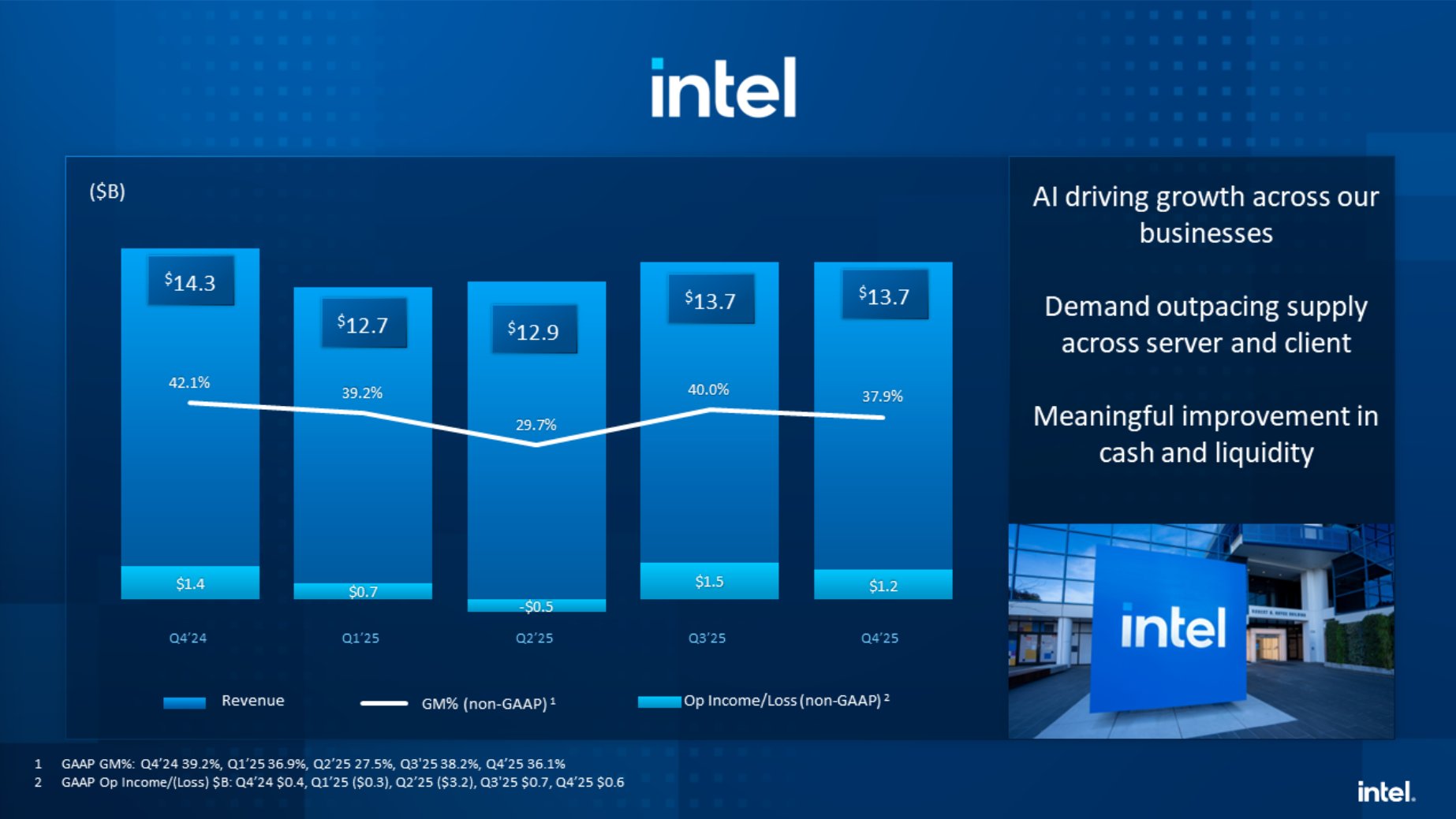

Financial results underscore Intel's strategic pivot. Though overall Q4 revenue declined 4% year-over-year to $13.7 billion, DCAI grew 9% to $4.7 billion – representing half of CCG's revenue but demonstrating stronger momentum. Full-year DCAI revenue reached $16.9 billion (up 5% YoY), though this growth lags competitors. AMD's Q3 2025 data center revenue grew 22% year-over-year, while Nvidia reported 66% annual growth in data center revenue during recent quarters.

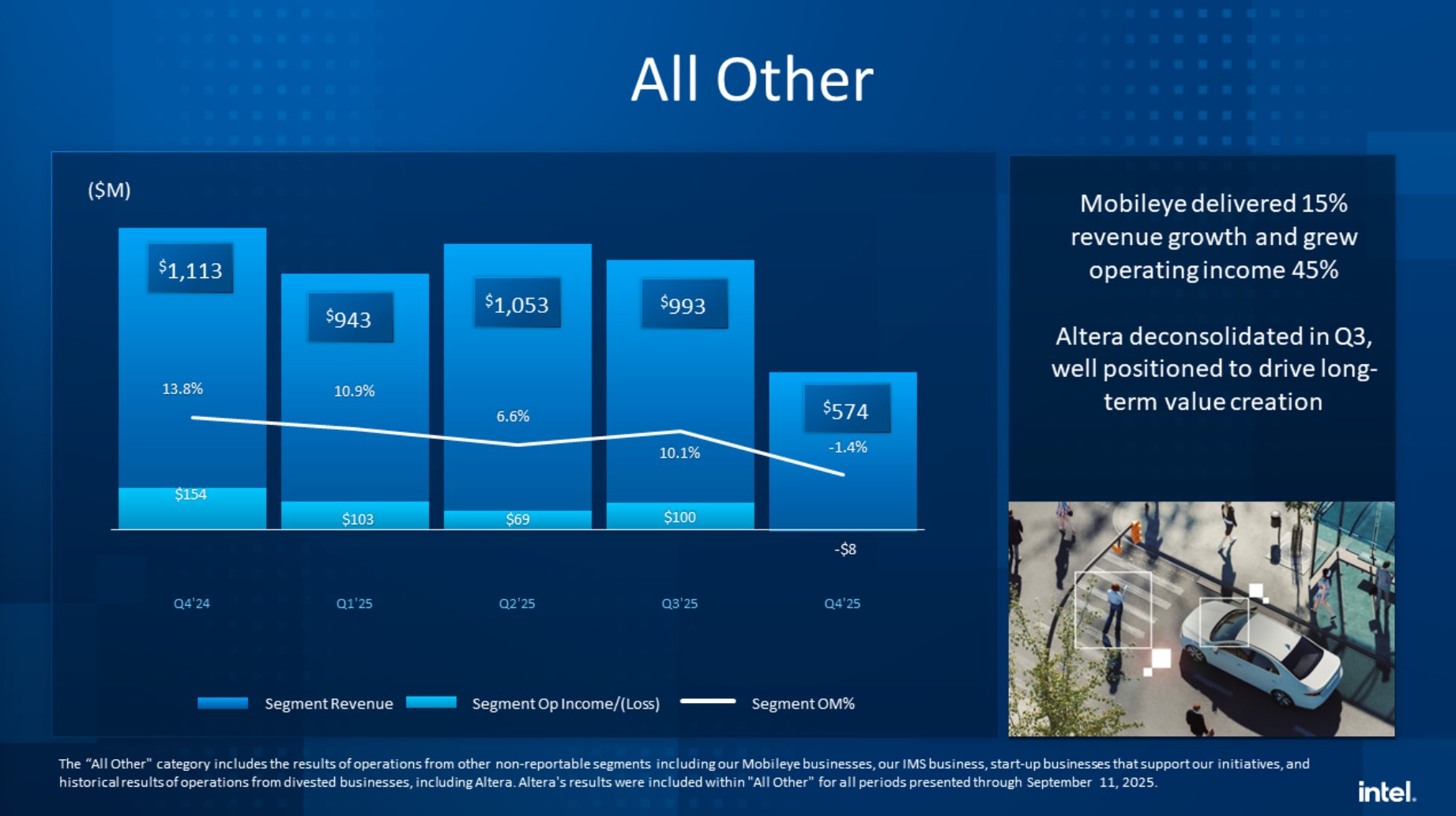

The foundry segment presents ongoing challenges. Despite 4% year-over-year revenue growth, Intel Foundry recorded a -55.7% operating margin with $2.5 billion quarterly losses. Other segments grouped under "All Other" – including the recently deconsolidated FPGA subsidiary Altera – saw revenue decline 48% year-over-year with an $8 million operating loss.

Intel's wafer allocation strategy reflects broader industry dynamics: prioritizing high-margin data center products while maintaining minimum client supply to avoid market abandonment. The company's ability to accelerate 18A yield improvements and execute on 14A development will determine its competitiveness against AMD's Zen 6 and beyond, particularly as component shortages continue impacting pricing and availability across consumer and enterprise segments.

Comments

Please log in or register to join the discussion