Nvidia refutes claims demanding full advance payments for H200 GPU orders from Chinese clients, clarifying it never charges for unreceived products while navigating complex US-China trade restrictions.

Nvidia has formally addressed market speculation regarding payment terms for its H200 AI accelerators, explicitly denying requirements for full upfront payments from Chinese customers. 'We do not require upfront payment and would never require customers to pay for products that they do not receive,' stated an Nvidia spokesperson in response to inquiries. This clarification follows reports suggesting the company imposed stringent prepayment conditions due to geopolitical uncertainties surrounding U.S. export controls.

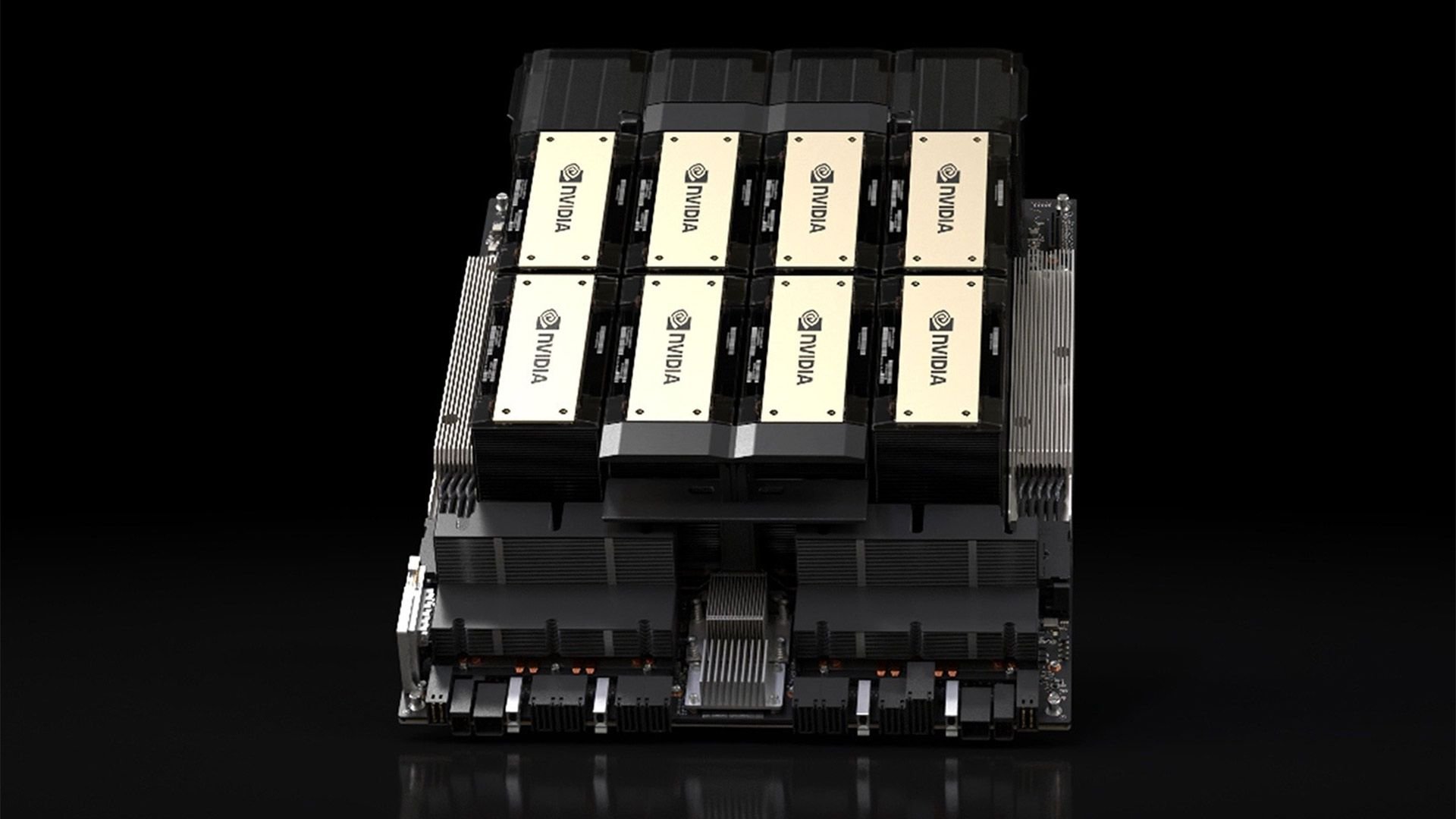

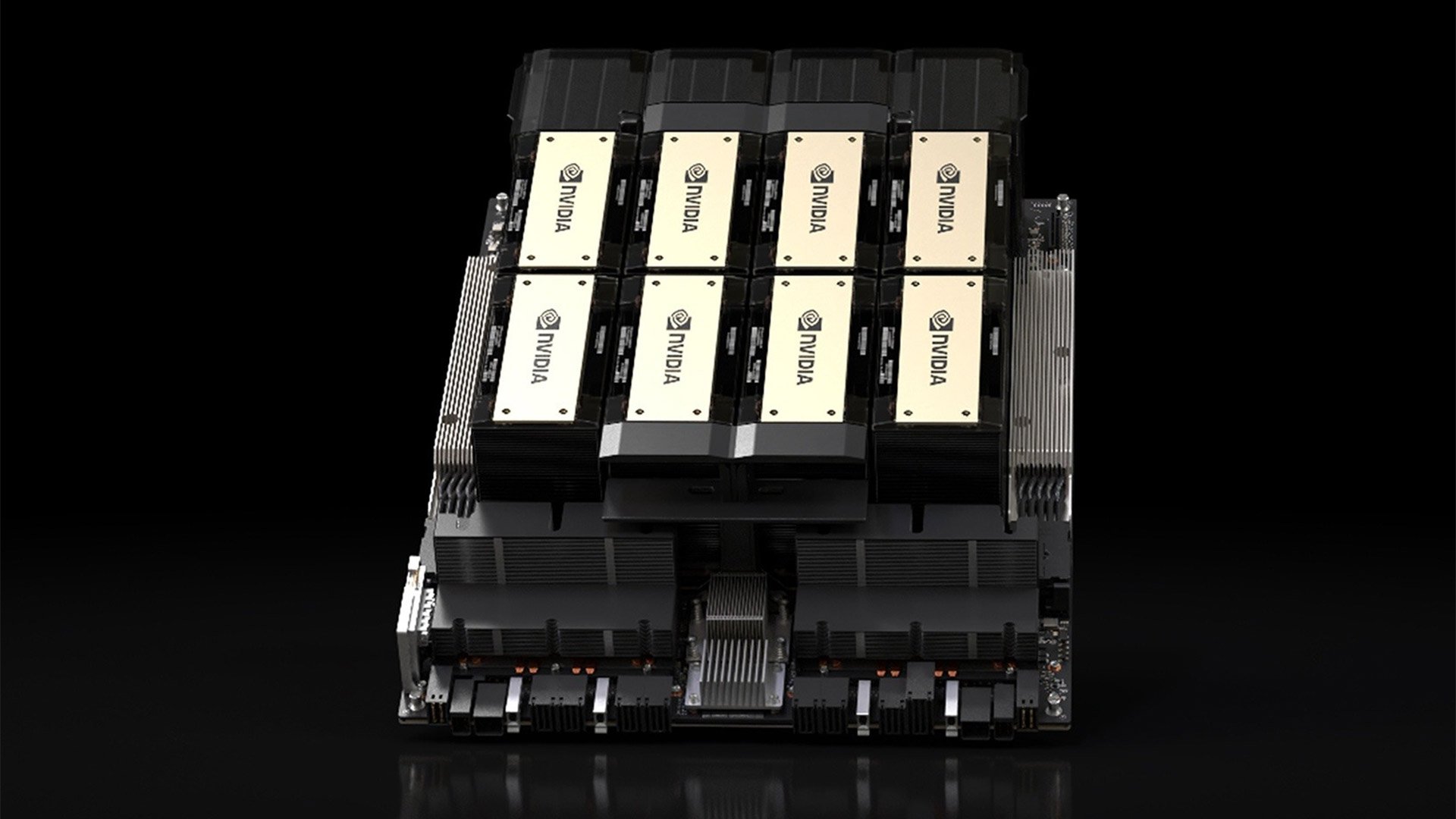

The H200 GPU, fabricated on TSMC's 4N process node, delivers 141GB of HBM3e memory with 4.8TB/s bandwidth—a 76% improvement over its predecessor H100. However, its position in the market has shifted dramatically since Nvidia's Blackwell architecture announcement. The Blackwell GB200 systems integrate two B200 GPUs and a Grace CPU, delivering 20 petaflops of FP4 performance—nearly 5x the H200's compute density. With next-generation Vera Rubin GPUs already announced for 2025, featuring advanced HBM4 memory and 3nm manufacturing, the H200 now occupies an awkward transitional position in Nvidia's roadmap.

Market dynamics compound this technical transition. Chinese tech giants including Alibaba and ByteDance have reportedly sought orders exceeding 200,000 H200 units collectively, despite export restrictions preventing their access to Blackwell products. This creates significant supply chain exposure: Should China's regulators block these orders last-minute, Nvidia could face inventory surpluses of architecture-limited chips with limited resale potential. Industry analysis suggests excess H200 inventory would also consume TSMC CoWoS advanced packaging capacity—resources that could otherwise produce Blackwell GB200 units commanding approximately 30% higher margins.

Nvidia's payment policy flexibility appears strategically calculated. Sources indicate the company maintains over 80,000 H200 chips in existing inventory, reducing production risk. Financially, this approach minimizes customer friction while preserving relationships with Chinese entities—a delicate balance amid ongoing U.S. trade policy negotiations. The decision reflects sophisticated supply chain risk management: By avoiding advance payment mandates, Nvidia shifts inventory exposure internally while maintaining positioning in a region accounting for approximately 20% of its data center revenue.

Long-term implications extend beyond payment terms. With H200 orders representing potential stopgap solutions for Chinese AI development, Nvidia's handling of this situation demonstrates how semiconductor manufacturers must increasingly navigate technical roadmaps alongside geopolitical constraints. The company's inventory management strategy highlights how fab capacity allocation, margin preservation, and diplomatic considerations now form critical variables in high-performance computing sales cycles.

Comments

Please log in or register to join the discussion