In 2025, US electricity demand grew by 135 TWh—the fourth-largest increase in a decade. Solar power alone provided 61% of that new capacity, a quiet but profound shift in how the grid meets its needs. The data reveals not just growth, but a fundamental change in grid dynamics.

The numbers from Ember's analysis tell a story of quiet transformation. US electricity demand jumped by 135 terawatt-hours in 2025, a 3.1% increase that marked the fourth-largest annual rise of the past decade. Against this backdrop, solar generation grew by a record 83 TWh—a 27% surge from 2024 that represents the biggest absolute gain of any power source. The math is stark: that single jump in solar output covered 61% of all new electricity demand nationwide.

This isn't merely about capacity additions; it's about timing and geography. Solar growth was essential in helping to meet fast-rising US electricity demand in 2025, as Dave Jones, chief analyst at Ember, noted. The power source generated where it was needed, and with the surge in batteries, increasingly when it was needed. The regional patterns are telling. Texas, the Midwest, and the Mid-Atlantic saw the largest increases in solar generation last year, and they were also the regions where electricity demand rose the fastest. Solar met 81% of demand growth in both Texas and the Midwest, and 33% in the Mid-Atlantic.

The timing aspect reveals how the grid is evolving. In aggregate, the increase in solar generation met the entire rise in US electricity demand during daytime hours between 10 am and 6 pm Eastern. This represents a fundamental shift from the traditional model where demand growth required new fossil fuel plants running continuously. Instead, solar is absorbing the incremental load during peak production hours.

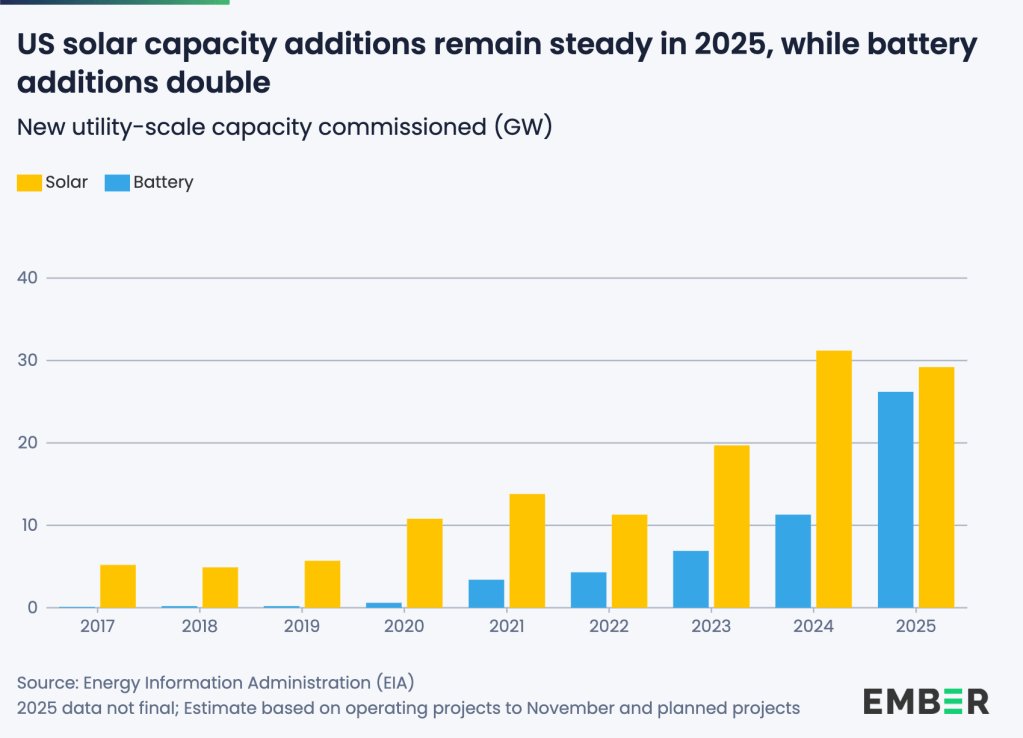

The story gets more interesting when we consider battery storage. As a result of the rapid buildout of battery storage, solar also helped cover some of the demand growth during the evening hours, from 6 pm to 2 am. The adoption of battery storage is turning solar from cheap daytime power into something far more flexible. Over the past six years, California's utility-scale solar and battery generation has climbed 58%. Yet, output at the sunniest hour of the day has increased by just 8%. This discrepancy reveals a crucial trend: more energy is being stored and used later, rather than dumped onto the grid all at once.

This represents a maturation of the solar ecosystem. Early solar adoption often created the "duck curve" problem—too much power during midday, requiring curtailment or rapid ramping of other sources. The integration of storage changes this dynamic fundamentally. Solar is no longer just a daytime power source; it's becoming a dispatchable asset that can shift energy to when it's needed most.

The implications extend beyond simple capacity metrics. Most of the new solar generation in 2025 was absorbed by rising electricity demand, allowing solar to scale alongside overall grid growth. This is significant because it means solar isn't just replacing existing generation—it's carrying the weight of new demand. In previous years, solar growth often competed with existing power sources, creating market tensions. Now, it's meeting the incremental needs of a growing grid.

The regional concentration also matters for grid planning. The fact that solar met 81% of demand growth in Texas and the Midwest suggests these regions are becoming solar-first markets. This has implications for transmission planning, market design, and the future role of other generation sources. The Mid-Atlantic's 33% figure, while lower, still represents a substantial share of new demand being met by solar.

Looking forward, the trajectory suggests even more dramatic shifts. As Jones stated, "Solar has the potential to meet all the rise in electricity demand and much more. With electricity demand surging, the case to build solar has never been stronger." This isn't just optimism—it's a logical extension of current trends. If solar met 61% of demand growth in 2025 with continued cost declines and storage integration, meeting 100% of future demand growth becomes plausible within years, not decades.

However, this growth pattern raises questions about grid architecture and market design. The traditional utility model, built around baseload and peaking plants, faces disruption when a single source can meet most incremental demand. How do markets compensate for capacity that only runs during specific hours? What happens to the economics of natural gas plants that were built to meet demand growth? These aren't theoretical questions—they're already playing out in regional markets.

The storage component adds another layer of complexity. Battery storage costs have fallen dramatically, but the economics still depend on specific market structures and rate designs. The fact that California's solar output at the sunniest hour increased by just 8% while total solar+battery generation climbed 58% suggests storage is already changing generation patterns. But this also means solar's value proposition is shifting from pure generation to energy arbitrage.

For developers and investors, the 2025 data provides a clear signal: solar with storage is no longer an alternative technology but the primary solution for meeting new electricity demand. The 61% figure isn't just a market share—it's a validation of the technology's ability to scale alongside grid growth. This changes risk calculations, financing models, and long-term planning assumptions.

The broader energy transition narrative often focuses on replacing fossil fuels. The 2025 data suggests a different story: solar is becoming the default choice for new capacity, regardless of the transition. When demand grows, solar is the first and most economical answer. This creates a self-reinforcing cycle where each new solar installation makes the grid more solar-friendly, reducing the need for complementary technologies and further lowering the effective cost of solar integration.

As we look to 2026 and beyond, the question isn't whether solar will continue to grow, but how quickly the grid can adapt to a generation source that produces most of its value during specific hours and increasingly relies on storage to extend that value. The 2025 numbers show the transition is already well underway, not as a future promise but as a present reality.

The quiet revolution in the US power sector isn't happening in headlines about coal plant closures or EV adoption. It's happening in the incremental data points: 135 TWh of new demand, 83 TWh of new solar, and the 61% figure that represents solar's emergence as the grid's workhorse for growth.

Comments

Please log in or register to join the discussion