For the first time since 1999, Taiwan's exports to the US surpassed shipments to China in 2025, driven by explosive demand for AI infrastructure components like servers and GPUs. This 26-year milestone creates new economic risks as Taiwan's trade surplus with America widens.

Taiwan's Export Shift: AI Tech Demand Drives Record US Trade Surplus Amid Tariff Concerns

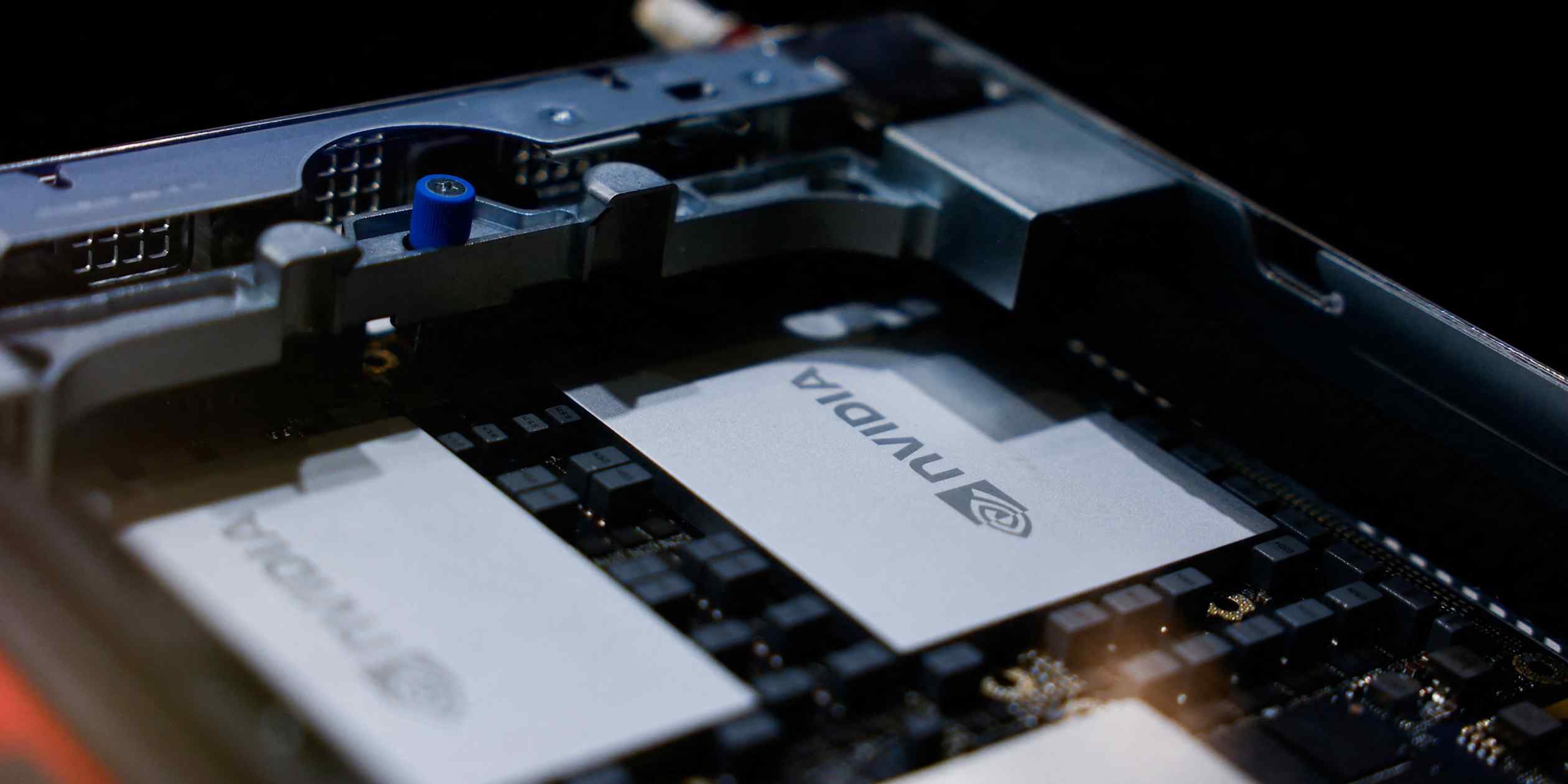

Taiwan's export patterns underwent a historic realignment in 2025, with shipments to the United States exceeding those to mainland China and Hong Kong for the first time in 26 years. Official data reveals this reversal stems primarily from surging American demand for artificial intelligence hardware, including servers equipped with advanced graphics processors. The shift carries significant strategic implications as Taiwan's goods trade surplus with the US expands, potentially triggering renewed tariff pressure under a possible Trump administration.

The Numbers Behind the Shift

- Export Volume: US-bound exports reached unprecedented levels in 2025, surpassing the combined China-Hong Kong total by approximately 3.2% in dollar terms

- Key Products: AI server systems accounted for 38% of the year-over-year export growth to the US, with GPU-equipped units seeing 74% shipment increases

- Manufacturing Footprint: Unlike consumer electronics largely produced in mainland China, Taiwan-based facilities like Foxconn's server production lines now handle over 60% of US-destined AI hardware

- Surplus Expansion: Taiwan's trade surplus with America widened by 19% year-over-year, contrasting with narrowing deficits in consumer goods categories

Geopolitical Production Patterns

The AI hardware boom has reinforced Taiwan's strategic manufacturing advantage. Major suppliers like Foxconn maintain server assembly lines on the island, leveraging proximity to Taiwan Semiconductor Manufacturing Company (TSMC) fabs producing cutting-edge chips. This contrasts sharply with smartphone and laptop production, predominantly located in mainland China. The bifurcation creates supply chain resilience for US tech firms seeking to reduce China exposure while accessing Taiwan's concentrated expertise in high-performance computing infrastructure.

Market Implications and Risks

- Tariff Vulnerability: The widening surplus makes Taiwan an easier target for US trade measures. Historical precedent shows the Trump administration imposed tariffs on allies with persistent surpluses, including Section 301 duties reaching 25%.

- Geopolitical Tightrope: Taiwan must balance thriving US tech partnerships with avoiding actions that might provoke Chinese economic retaliation. Cross-strait tensions complicate export strategies as mainland China remains Taiwan's second-largest market.

- Capacity Constraints: Taiwan's server makers face production bottlenecks despite expanding facilities. Lead times for high-end GPU-equipped systems extended to 36 weeks in Q4 2025, potentially delaying AI deployments across US cloud providers.

Strategic Outlook

This export milestone signals structural changes beyond cyclical demand shifts. US tech decoupling from China accelerates investment in Taiwan's AI infrastructure ecosystem, with companies like Foxconn allocating over $2.1 billion for new Taiwanese production lines in 2026. However, the ballooning trade surplus creates economic vulnerability. If Trump returns to office, Taiwan could face pressure to voluntarily limit exports or accept new tariffs unless diplomatic channels establish safeguards. Meanwhile, Taiwan's central bank shifted to quarterly forex intervention reports, signaling awareness of currency manipulation scrutiny.

Long-term sustainability requires Taiwanese manufacturers to diversify beyond hardware assembly into AI software and services while navigating political risks. The island's pivotal role in global AI infrastructure now brings both economic opportunity and unprecedented trade policy exposure as geopolitical and commercial forces converge.

Comments

Please log in or register to join the discussion