Tesla's new Robotaxi service in Austin and San Francisco offers rides at roughly half the price of Uber, Lyft, and Waymo, with an average trip costing just $8 compared to double that for competitors.

Tesla's newly launched Robotaxi ride share platform is making waves in the autonomous vehicle market by offering prices that significantly undercut established competitors like Uber, Lyft, and Waymo. Operating in cities such as Austin and San Francisco with 2026 Model Y vehicles, Tesla's pricing strategy appears designed to rapidly gain market share in the emerging robotaxi sector.

Tesla's Pricing Advantage

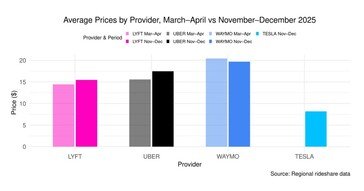

The most striking aspect of Tesla's Robotaxi service is its aggressive pricing. According to recent data analysis, Tesla charges only $1.99 per kilometer ($3.20 per mile) for its autonomous rides, compared to Waymo's average rate of nearly three times that amount. This pricing advantage translates to an average trip cost of just $8 in San Francisco, while the next cheapest option, Lyft, costs approximately double.

This pricing strategy puts Tesla in a unique position within the robotaxi market. While Waymo has traditionally been more expensive than traditional ride-sharing services like Uber and Lyft, Tesla's entry has created a new pricing paradigm. The data, compiled from an average of 94,348 rides, includes both trip prices and wait times across all major ride-sharing services.

The Trade-off: Longer Wait Times

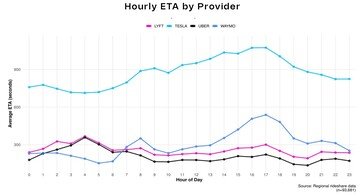

However, Tesla's aggressive pricing comes with a notable trade-off: longer wait times. While Tesla's Model Y robotaxi rides are priced in the single digits, passengers can expect to wait approximately 15 minutes for their vehicle to arrive. In comparison, Waymo's wait times average just over five minutes, nearly matching traditional ride-sharing services like Lyft.

This discrepancy in wait times is largely attributable to fleet size. Waymo operates over a thousand automated driverless vehicles in the Bay Area, while Tesla currently has approximately 156 Model Y units operating on FSD (Unsupervised) software. The smaller fleet size naturally results in longer wait times, but Tesla is rapidly expanding its robotaxi count.

Market Dynamics and Adoption Strategy

Tesla's pricing strategy appears to mirror the early days of Uber and Lyft, when both companies offered heavily discounted rides to build market share and customer loyalty. By offering unbeatable prices, Tesla is effectively "buying adoption" of its Robotaxi platform, compensating for its current disadvantages such as a smaller fleet and longer wait times.

The company has already begun expanding its operations, recently starting to offer unsupervised rides without a safety monitor in Austin, similar to Waymo's approach. Tesla's AI chief has indicated that the share of unsupervised rides will continue to grow as the fleet expands and technology improves.

Consumer Sentiment and Market Acceptance

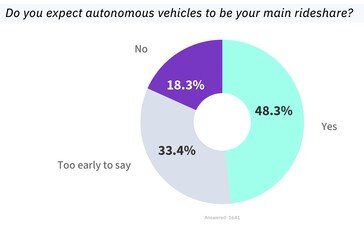

Interestingly, a survey of study respondents reveals that robotaxis are no longer viewed as a novelty, at least in the Bay Area. Nearly half of respondents expect a robotaxi to arrive when they request a ride, indicating growing acceptance and normalization of autonomous vehicle services.

This shift in consumer perception is crucial for the long-term success of robotaxi services. As more people become comfortable with the concept of driverless vehicles, the market for autonomous ride-sharing is likely to expand significantly.

Competitive Landscape

The robotaxi market is becoming increasingly competitive, with each player bringing different strengths to the table. Waymo, as the pioneer in fully autonomous ride-sharing, has established infrastructure and experience but has struggled to match the pricing of traditional ride-sharing services. Uber and Lyft, while not offering fully autonomous rides, maintain the largest fleets and shortest wait times.

Tesla's entry into this market with its pricing strategy represents a significant disruption. By offering prices that are roughly half of its competitors, Tesla is forcing other players to reconsider their pricing models and potentially accelerate their own autonomous vehicle development.

Future Outlook

As Tesla continues to expand its robotaxi fleet and improve its technology, the balance between pricing and wait times is likely to shift. The company's aggressive expansion plans and the increasing share of unsupervised rides suggest that wait times will decrease over time, potentially making Tesla's Robotaxi service the most attractive option on multiple fronts.

The robotaxi market is still in its early stages, and Tesla's pricing strategy may well be the catalyst needed to accelerate widespread adoption of autonomous ride-sharing services. As the technology matures and more vehicles enter service, the industry could see a fundamental shift in how people think about urban transportation.

For consumers, the immediate benefit is clear: significantly cheaper rides. Whether Tesla can maintain this pricing advantage while scaling its operations and improving service quality will be one of the most interesting developments to watch in the autonomous vehicle space over the coming years.

Comments

Please log in or register to join the discussion