Sensor Tower's State of Mobile 2026 report reveals a pivotal shift in the mobile ecosystem: TikTok remains the undisputed leader in downloads, revenue, and engagement, while AI apps like ChatGPT experience explosive growth. For developers, this signals a move away from traditional gaming revenue models and toward AI-integrated services and short-form content. The data underscores the need to adapt to new user behaviors and platform dynamics.

The annual Sensor Tower State of Mobile 2026 report has landed, and for mobile developers, it paints a picture of an industry in transition. While app downloads remained stable year-over-year, the composition of the top charts has shifted dramatically. TikTok continues its reign, but the most explosive growth belongs to AI assistants and a new category called "Short Drama." For developers building on iOS and Android, this isn't just trivia—it's a roadmap to where user attention and spending are flowing.

The Unshakeable Reign of TikTok

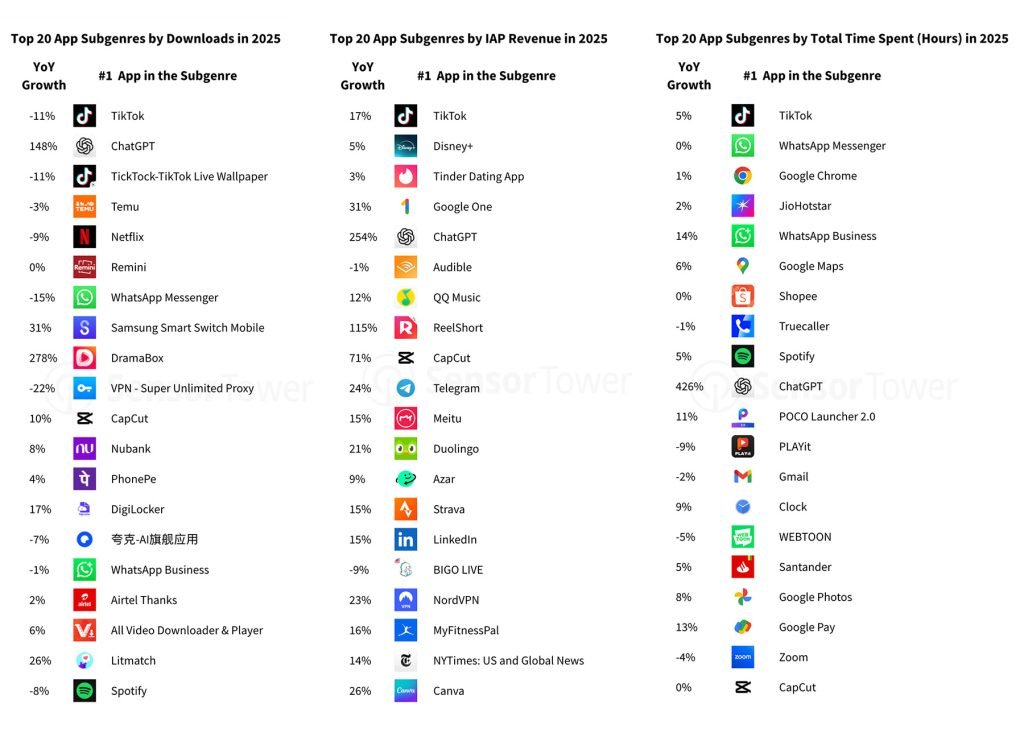

TikTok's dominance is absolute. According to Sensor Tower's data, it topped worldwide downloads, in-app purchase revenue, and total time spent in 2025. This isn't a surprise, but the scale is staggering. The report notes that consumers spent nearly 2.5 trillion hours on social media apps, accounting for over 90 minutes per day for the average mobile user. That's a 5% increase from the previous year.

For developers, this reinforces a fundamental truth: the social graph and algorithmic content discovery are the most powerful engagement engines on mobile. Building a standalone app that competes with TikTok's core loop is nearly impossible. Instead, the opportunity lies in integration. Can your app's content be shared to TikTok? Can you leverage TikTok's SDK for authentication or social features? The platform's API and developer tools are constantly evolving, and understanding them is key to tapping into this massive audience.

The AI Surge: ChatGPT and the New App Category

The most dramatic story in the report is the rise of AI. ChatGPT alone saw downloads surge 148%, in-app purchase revenue jump 254%, and total time spent skyrocket by 426%. This propelled it to the #2 spot in global app downloads, right behind TikTok.

This growth isn't isolated. The report identifies "AI Assistants" as the 10th-largest app category by total time spent, with a 426% year-over-year surge. The top AI apps by downloads were:

- ChatGPT

- Google Gemini

- DeepSeek

- Doubao

- Perplexity

- Grok

- Adobe Acrobat Reader

- Seekee

- Meta AI

- Microsoft Copilot

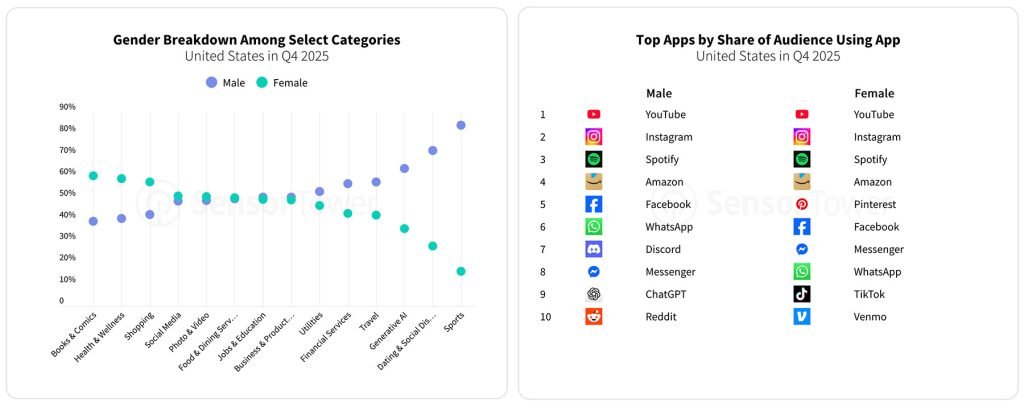

For developers, this signals a massive shift. The standalone AI chatbot app is now a proven, high-growth category. But more importantly, AI is becoming a foundational layer. Integrating AI features—whether for content generation, personalization, or customer service—is no longer a luxury; it's a competitive necessity. The report also highlights that ChatGPT became the 9th most used app for men in the US during Q4 2025, indicating strong adoption across demographics.

The New Contender: Short Drama

Alongside AI, a new subgenre emerged as a breakout star: "Short Drama." This category, which typically features serialized, episodic content in a mobile-first format, ranked among the top three by growth in downloads and in-app purchase revenue. This trend is particularly relevant for developers in the video streaming and entertainment space. It suggests a user appetite for bite-sized, narrative-driven content that can be consumed in short sessions, contrasting with traditional long-form video streaming.

The Gaming Paradox

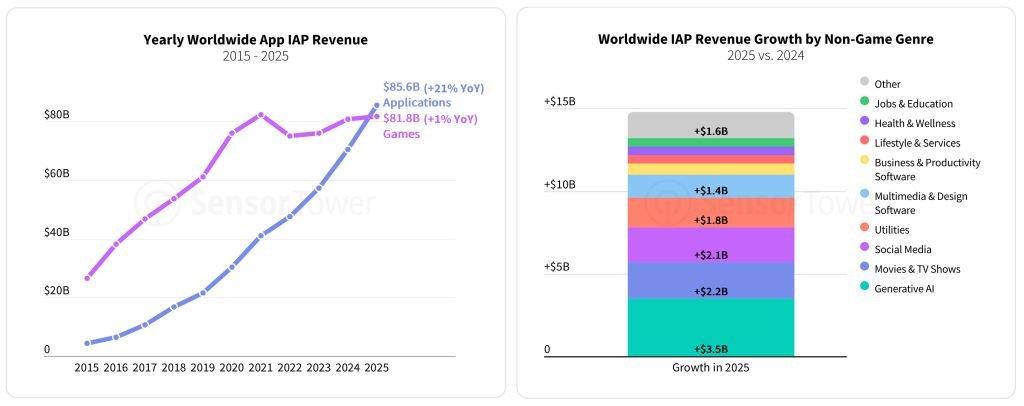

The report presents a paradox for game developers. While mobile games revenue rose 1% in 2025, downloads dropped by 7% compared to 2024. This indicates that the gaming market is maturing. User acquisition is becoming more expensive and challenging, but those who do engage are spending more. The top downloaded game globally was "Block Blast!"—a simple, hyper-casual puzzle game. This highlights the enduring appeal of accessible, low-friction gameplay.

For game developers, the takeaway is twofold. First, the focus must shift from pure download volume to user retention and monetization. Live operations, seasonal events, and community building are more critical than ever. Second, the hyper-casual and puzzle genres remain viable entry points, but standing out requires exceptional polish and a clever twist on proven mechanics.

Demographic and Regional Nuances

The report offers a granular look at user behavior. In the US, during Q4 2025, Pinterest, TikTok, and Vemo appeared exclusively in the top 10 apps for women, while ChatGPT ranked highly for men. This gender-based segmentation is crucial for targeted marketing and feature development. An app that resonates with one demographic may not with another.

Furthermore, the report encourages developers to "scroll through the different markets to see where AI Assistants are gaining traction the fastest." This is a critical exercise. The adoption curve for AI and new content formats varies by region due to cultural preferences, connectivity, and local competition. A one-size-fits-all global launch strategy is increasingly risky. Developers should use market intelligence tools (like Sensor Tower's own platform) to identify regional opportunities and tailor their app store listings and marketing accordingly.

Practical Implications for Mobile Developers

- Monetization Strategy: With consumers spending more in apps than in games for the first time, non-gaming apps must refine their subscription and in-app purchase models. The success of ChatGPT's premium tiers shows a clear path for value-based pricing in AI services.

- Feature Integration: Consider integrating TikTok's sharing features or leveraging AI APIs (like OpenAI's, Google's, or others) to enhance your app's core functionality. Don't build everything from scratch; use the ecosystem.

- Content Format Experimentation: If you're in the video or social space, experiment with short-form, episodic content. The "Short Drama" trend is a clear signal of user preference.

- Platform-Specific Optimization: While the report aggregates data, remember that iOS and Android users have different behaviors. iOS users typically spend more, which is reflected in the App Store's revenue figures. Android dominates in download volume in many regions. Tailor your app's features and monetization to the platform's strengths.

Conclusion: Adapt or Be Left Behind

The State of Mobile 2026 report is a clear call to action. The mobile landscape is no longer just about games and social media. It's about AI-powered services, new content formats, and a more mature, retention-focused gaming market. For developers maintaining apps on both iOS and Android, the mandate is to stay platform-aware, pragmatic, and data-driven. The trends are clear: build for engagement, leverage AI, and don't ignore the power of short-form content. The next breakout app will likely sit at the intersection of these forces.

Comments

Please log in or register to join the discussion