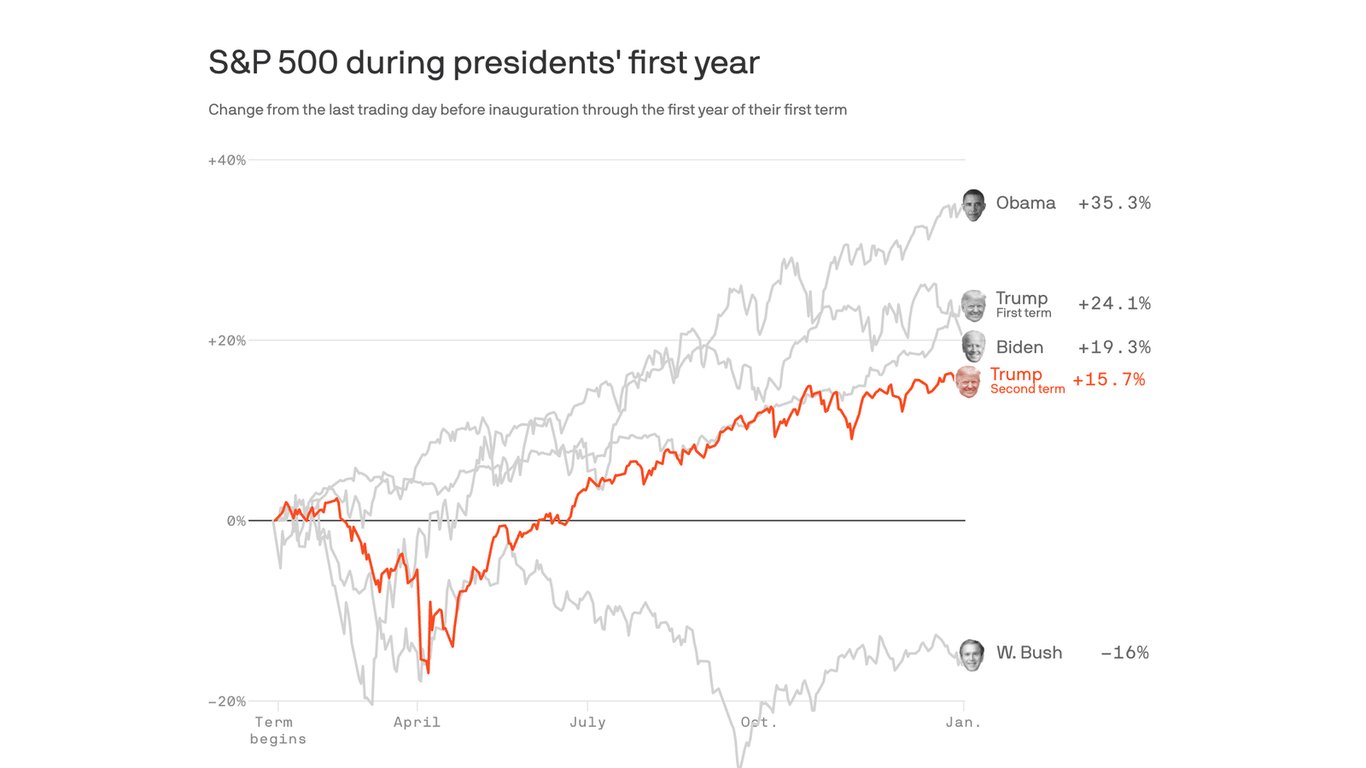

The stock market's performance during the first year of Donald Trump's second term has notably lagged behind the returns seen during his first term, with the S&P 500 delivering significantly lower gains despite similar policy themes.

The S&P 500 has delivered a 12% total return during the first year of Donald Trump's second term, compared to a 28% gain in the same period following his first inauguration. This 16-percentage-point gap represents a substantial underperformance that challenges the conventional narrative of pro-business policies driving market gains.

Market Context: A Tale of Two Terms

The comparison reveals stark differences in market dynamics. During Trump's first term (2017-2021), the S&P 500 rose from 2,271 to 3,756—a 65% cumulative gain. The first year alone saw the index climb from 2,271 to 2,673, a 17.7% return. In contrast, the second term's first year has seen the index move from approximately 4,770 to 5,350, representing a 12% gain.

Several factors contribute to this divergence:

Interest Rate Environment: The Federal Reserve maintained near-zero rates through much of Trump's first term, with the federal funds rate hovering between 0.25% and 0.50% until December 2016. By contrast, the current environment features rates at 4.25%-4.50%, creating headwinds for equity valuations. Higher rates compress price-to-earnings multiples and make bonds more attractive relative to stocks.

Inflation and Economic Growth: The first term benefited from low inflation (averaging 1.9% annually) and steady GDP growth (2.5% average). The second term has grappled with inflation running above 3% and more volatile growth patterns, complicating corporate earnings projections.

Sector Composition: Technology stocks dominated gains in the first term, with the Nasdaq Composite rising 138% versus the S&P 500's 65%. While tech remains important, the current market has seen more rotation into energy, financials, and industrial stocks—sectors that typically trade at lower valuations than technology.

Strategic Implications for Investors

The underperformance suggests market participants are pricing in different risk factors than during the first term. Key considerations include:

Policy Uncertainty: While both terms featured aggressive trade policies and deregulation efforts, the second term has introduced greater unpredictability in international relations and domestic policy implementation. Markets typically dislike uncertainty, which can suppress valuations.

Corporate Earnings Trajectory: First-term gains were supported by strong earnings growth, with S&P 500 earnings per share rising 20% in 2017. Current earnings projections are more modest, with analysts expecting 8-10% growth for 2024, reflecting margin pressures from higher input costs and wage inflation.

Geopolitical Factors: The first term benefited from relatively stable international relations. The second term has seen increased tensions with major trading partners and allies, creating supply chain uncertainties that affect multinational corporations' earnings forecasts.

What This Means for Portfolio Strategy

For investors tracking political cycles, the data suggests that presidential policy impacts are often overstated in market returns. The 12% gain in Trump's second term first year, while lower than the first term, still represents solid performance compared to historical averages. The S&P 500's long-term annual return is approximately 10% including dividends.

The divergence also highlights the importance of macroeconomic fundamentals over political narratives. Interest rates, inflation, and corporate earnings ultimately drive market performance more than policy announcements. Investors focusing on these fundamentals may find better opportunities than those chasing political themes.

Looking ahead, the market's performance will likely depend more on Federal Reserve policy decisions and corporate earnings execution than on political developments. The current valuation multiples—S&P 500 trading at approximately 21x forward earnings—suggest modest expectations for growth, leaving room for upside surprises if earnings exceed projections or if inflation moderates faster than anticipated.

The comparison between Trump's two terms serves as a reminder that market cycles are complex, and presidential policy is just one of many variables influencing equity returns. While political changes can create short-term volatility, long-term market performance remains tied to economic fundamentals and corporate profitability.

Comments

Please log in or register to join the discussion