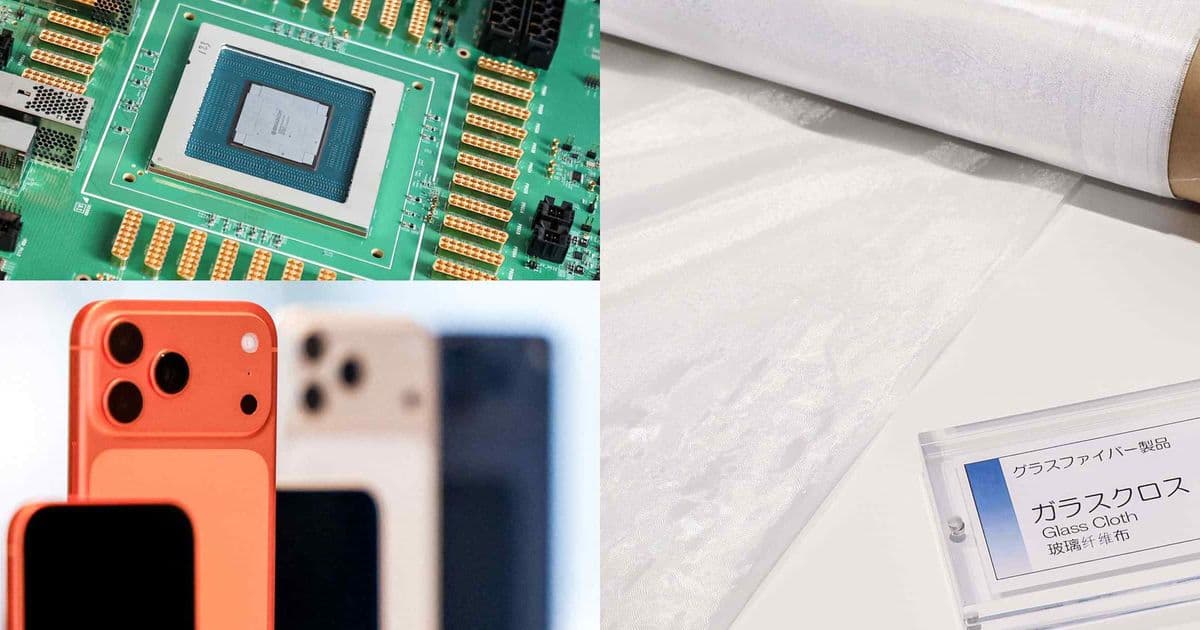

Two of the world's largest chip buyers are scrambling to secure glass cloth fiber, a critical component for advanced chip substrates and PCBs, as the AI infrastructure buildout creates unprecedented demand for the specialized material.

Apple and Qualcomm are actively competing to secure supplies of glass cloth fiber, a specialized material essential for manufacturing high-performance chip substrates and printed circuit boards, according to sources familiar with the matter. The scramble reflects how the artificial intelligence boom is creating cascading shortages across the semiconductor supply chain.

Glass cloth fiber serves as a foundational material in advanced packaging technologies, particularly for substrates that connect silicon dies to printed circuit boards in high-performance chips. The material's importance has grown exponentially as chipmakers push the limits of performance and density for AI accelerators, which require increasingly sophisticated packaging solutions.

The Material at the Center of the Shortage

Glass cloth fiber is a woven material made from extremely fine glass filaments, typically less than 10 microns in diameter. Unlike traditional fiberglass used in construction, the glass fibers in chip substrates must meet extraordinarily tight specifications for purity, consistency, and thermal properties. The material provides structural support while maintaining precise electrical characteristics needed for high-frequency signal transmission.

In advanced chip packaging, glass cloth fiber forms the base layer of substrates that can contain dozens of layers of intricate circuitry. These substrates must manage heat dissipation, maintain dimensional stability under thermal stress, and provide reliable connections between silicon dies and the broader system. For AI chips, which operate at extremely high power densities and processing speeds, substrate quality directly impacts performance and reliability.

The manufacturing process for glass cloth fiber requires specialized equipment and controlled environments. The glass filaments are drawn from molten glass through tiny nozzles, then woven into cloth with precise patterns. Even minor variations in fiber diameter or weave consistency can create signal integrity issues in high-speed applications. This specialization means there are limited suppliers globally who can produce glass cloth fiber meeting chip industry standards.

Why Demand Has Exploded

The current shortage stems from multiple converging factors in the AI hardware market. First, the sheer volume of AI accelerator production has increased dramatically. Major cloud providers are ordering hundreds of thousands of advanced GPUs and custom AI chips quarterly, each requiring sophisticated substrates.

Second, AI chips themselves are becoming more complex. Modern accelerators use chiplet architectures, where multiple silicon dies are integrated into single packages. These multi-die packages require larger, more sophisticated substrates with higher layer counts. A single AI accelerator package might use substrates containing 20 or more layers of glass cloth fiber.

Third, the transition to advanced packaging technologies like chip-on-wafer-on-substrate (CoWoS) and integrated fan-out (InFO) increases substrate complexity. These packaging methods, essential for AI chips, demand glass cloth fiber with even tighter specifications.

The shortage is particularly acute because glass cloth fiber production capacity hasn't kept pace with the explosive growth in AI chip demand. Building new production lines takes 18-24 months, and suppliers have been conservative about capacity expansion, uncertain whether AI demand would sustain long-term growth.

Impact on Apple and Qualcomm

For Apple, glass cloth fiber shortages could affect production of custom silicon chips used in iPhones, iPads, and Macs. The company's A-series and M-series chips rely on advanced packaging that requires high-quality substrates. While Apple typically secures long-term supply agreements, the sudden surge in AI-related demand has tightened the market across all customers.

Qualcomm faces similar challenges with its Snapdragon processors and AI accelerators. The company supplies chips for Android smartphones and is expanding into automotive and edge AI applications. Each of these markets requires reliable access to advanced substrates.

Both companies are reportedly offering premium pricing and long-term commitments to secure supply. Some sources indicate they're exploring direct investments in substrate suppliers or joint ventures to guarantee capacity. This level of supply chain intervention is unusual for companies that typically rely on their chip manufacturing partners to manage substrate procurement.

Broader Market Implications

The glass cloth fiber shortage illustrates a critical vulnerability in the semiconductor supply chain. While much attention focuses on chip fabrication capacity and advanced lithography equipment, substrate materials represent an equally important bottleneck. The issue is compounded by the concentration of substrate manufacturing in Asia, particularly Taiwan, Japan, and South Korea.

This shortage also highlights how AI is reshaping material requirements across the electronics industry. Traditional substrate materials designed for mobile and computing chips may not meet the thermal and electrical demands of AI accelerators. Suppliers are racing to develop next-generation glass cloth fiber with improved thermal conductivity and lower dielectric loss.

The situation has prompted discussions about supply chain diversification. Some industry observers suggest that substrate material suppliers need the same strategic attention as chip fabrication equipment. Government initiatives in the US and Europe to rebuild domestic semiconductor manufacturing may need to include substrate materials to be truly comprehensive.

Looking Ahead

Industry analysts expect the glass cloth fiber shortage to persist through 2026, with gradual relief coming as new production capacity comes online. However, the fundamental demand drivers—AI infrastructure buildout and advanced chip packaging—show no signs of slowing.

The shortage may accelerate innovation in alternative substrate materials. Research into polymer-based substrates with glass fiber reinforcement, ceramic substrates, and even glass-core substrates could provide long-term solutions. Some chipmakers are also exploring substrate designs that use less glass cloth fiber without compromising performance.

For now, Apple and Qualcomm's scramble for supply demonstrates how the AI boom is creating ripple effects throughout the electronics ecosystem. As chips become more complex and AI applications proliferate, the materials and components that enable advanced packaging will remain critical chokepoints requiring strategic management and investment.

The glass cloth fiber shortage serves as a reminder that semiconductor innovation depends not just on transistor scaling and architectural breakthroughs, but on the often-overlooked materials that physically connect and support the silicon brain of modern computing.

Comments

Please log in or register to join the discussion