Micron's purchase of Powerchip Semiconductor's Taiwan fab signals a strategic shift away from technology-sharing partnerships as DRAM manufacturing costs soar.

Micron Technology has announced the acquisition of Powerchip Semiconductor Manufacturing Corporation's (PSMC) P5 fabrication facility in Tongluo, Taiwan, for $1.8 billion. This transaction, expected to close by Q2 2026, includes 300,000 square feet of cleanroom space capable of processing 300mm wafers. The site will begin meaningful DRAM production in late 2027 following equipment installation and process upgrades.

The Tongluo facility will significantly expand Micron's Taiwan manufacturing footprint, positioned near its existing Taichung operations. According to Micron executives, this proximity enables operational synergies critical for scaling output during a global DRAM shortage. Industry forecasts indicate data centers alone will consume 70% of DRAM supply by 2026, driving unprecedented demand that current production cannot satisfy.

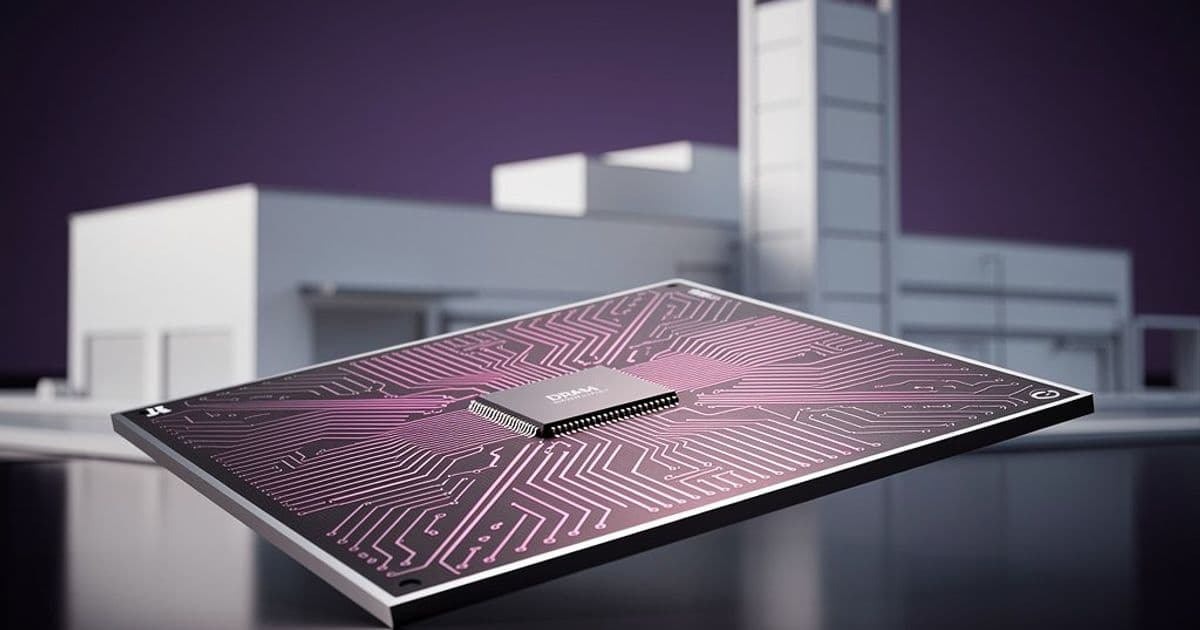

Micron's Hiroshima facility illustrates the scale of modern DRAM production infrastructure. (Image credit: Micron Electronics)

Micron's Hiroshima facility illustrates the scale of modern DRAM production infrastructure. (Image credit: Micron Electronics)

This acquisition fundamentally ends Micron's decades-long "technology-for-capacity" strategy in Taiwan. Historically, the company partnered with local foundries like PSMC, providing DRAM process technology in exchange for production capacity. This model proved effective at intermediate nodes (90nm to 20nm-class) when fab construction costs averaged $2-4 billion. Partners absorbed lower capital risks while accessing Micron's R&D-intensive process nodes.

Modern realities have rendered this approach obsolete. Next-generation DRAM fabs now require $15-25 billion investments, primarily due to extreme ultraviolet (EUV) lithography tools costing over $150 million per unit and extended yield-ramp timelines. At this scale, partners face prohibitive financial exposure without commensurate strategic benefits. As Micron's senior vice president Manish Bhatia noted, the Tongluo purchase directly addresses supply constraints in a market where "demand continues to outpace supply."

Financial metrics highlight the shift: Micron's last major partnership-based expansion occurred in 2016 with the Inotera acquisition for $4 billion. The Tongluo deal's $1.8 billion price tag reflects a functionally obsolete facility requiring substantial re-tooling, contrasting with Micron's upcoming $100 billion New York megafab complex featuring four 600,000 sq ft cleanrooms.

The transaction includes a legacy support agreement where PSMC will provide assembly services while Micron assists with PSMC's older DRAM products. This residual collaboration underscores the model's limited viability only for depreciated nodes or specialty memory not requiring cutting-edge processes. For leading-edge production, vertical integration now proves essential—Micron's ownership of Elpida (2013), Inotera (2016), and now PSMC's P5 demonstrates this irreversible industry pivot toward owned capacity as fabs become too expensive and strategically critical for shared operation.

Anton Shilov, Contributing Writer

Anton Shilov, Contributing Writer

Comments

Please log in or register to join the discussion