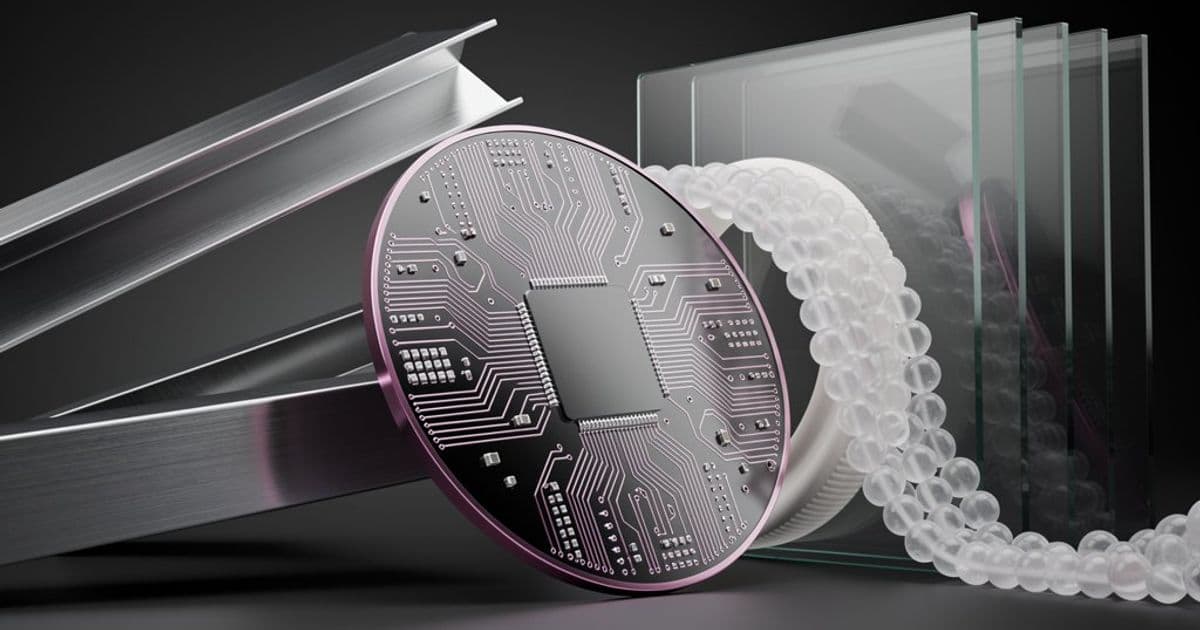

As Taiwanese chipmakers like TSMC and Foxconn accelerate localization efforts to secure supply chains, an unexpected wave of suppliers from traditional manufacturing sectors—steel, plastics, and displays—are pivoting into the semiconductor industry. This shift represents a strategic realignment to meet the growing demand for specialized materials and components in chip production, creating new opportunities and challenges in the global semiconductor ecosystem.

The Taiwanese semiconductor industry is undergoing a significant transformation as chipmakers intensify efforts to localize their supply chains. This push, driven by geopolitical tensions and the need for resilience, is attracting an unusual cast of companies from unrelated sectors. Suppliers to the steel, plastics, and display industries are now entering the chip sector, seeking to capitalize on the booming demand for specialized materials and components.

The Localization Imperative

Taiwanese chipmakers, led by giants like TSMC and Foxconn, have long relied on a global network of suppliers. However, recent disruptions and the specter of supply chain vulnerabilities have prompted a strategic shift toward domestic sourcing. This localization drive is not merely about reducing dependency on foreign suppliers; it's about building a more resilient, vertically integrated ecosystem that can withstand external shocks.

For instance, TSMC has been actively working with local suppliers to develop advanced packaging technologies and materials. This includes sourcing high-purity silicon wafers, specialty chemicals, and precision components from Taiwanese firms. The goal is to shorten lead times, improve quality control, and foster innovation within the local industry.

Unlikely Entrants: Steel, Plastics, and Display Suppliers

What makes this trend particularly noteworthy is the background of the new entrants. Companies that traditionally supplied steel, plastics, and display panels to other industries are now retooling their operations to meet the exacting standards of semiconductor manufacturing.

Steel Suppliers

Steel manufacturers are adapting their processes to produce ultra-high-purity steel alloys used in chip fabrication equipment. These alloys must meet stringent cleanliness and durability requirements to prevent contamination in cleanroom environments. For example, a Taiwanese steel company known for supplying automotive and construction sectors has invested in vacuum induction melting technology to produce specialty steels for semiconductor tools.

Plastics and Polymers

Plastic suppliers are developing advanced polymers for chip packaging, wafer carriers, and cleanroom consumables. These materials must be static-dissipative, chemically resistant, and capable of withstanding high temperatures. One supplier, previously focused on consumer goods packaging, has partnered with a local research institute to create polymer blends that meet the thermal and mechanical demands of advanced chip packaging.

Display Industry Suppliers

Companies from the display sector are leveraging their expertise in thin-film technologies and precision coating to produce components for semiconductor manufacturing. This includes depositing ultra-thin layers of materials onto wafers, a process critical for creating transistors and interconnects. A leading display panel manufacturer has repurposed its deposition equipment to produce high-precision masks and photomasks for lithography processes.

The Challenges of Cross-Sector Pivots

While the opportunities are significant, the transition is not without hurdles. Semiconductor manufacturing requires a level of precision and cleanliness that is orders of magnitude higher than traditional manufacturing. Suppliers must invest heavily in cleanroom facilities, advanced metrology tools, and quality management systems.

Moreover, the certification process for semiconductor suppliers is rigorous. Companies must pass audits from chipmakers and meet international standards such as ISO 9001 for quality management and SEMI standards for equipment and materials. This often involves years of development and testing before a supplier can become a qualified vendor.

Economic and Strategic Implications

The influx of new suppliers is expected to boost Taiwan's domestic semiconductor ecosystem, creating a more self-reliant industry. This aligns with government initiatives like the Taiwan Semiconductor Industry Association (TSIA) roadmap, which aims to increase local content in chip production.

Economically, this shift could generate significant revenue for traditional manufacturing sectors that have faced stagnation. For example, the steel industry in Taiwan has been grappling with overcapacity and low margins. Diversifying into high-value semiconductor materials could revitalize the sector.

Strategically, this localization reduces the risk of supply chain disruptions. By sourcing critical materials domestically, Taiwanese chipmakers can better control costs, lead times, and quality. This is particularly important given the ongoing trade tensions between the US and China, which have already impacted global semiconductor supply chains.

Case Study: A Steel Supplier's Journey

Consider the case of a Taiwanese steel company that has been supplying automotive and construction industries for decades. Facing declining demand in traditional markets, the company identified an opportunity in the semiconductor sector. It invested in a new production line for ultra-high-purity stainless steel, which is used in the fabrication of semiconductor equipment such as etching and deposition tools.

The company worked closely with TSMC and other chipmakers to understand their specific requirements. This involved developing alloys with extremely low levels of impurities (parts per billion) and ensuring consistent grain structure. After two years of R&D and pilot production, the company became a qualified supplier, supplying steel components for several key tools in TSMC's fabs.

The Role of Government and Research Institutions

The Taiwanese government has played a crucial role in facilitating this transition. Through initiatives like the Industrial Development Bureau (IDB) and the Ministry of Economic Affairs (MOEA), the government provides subsidies, tax incentives, and technical support to companies looking to enter the semiconductor supply chain.

Research institutions such as the Industrial Technology Research Institute (ITRI) and the National Applied Research Laboratories (NARLabs) offer expertise in materials science, process engineering, and quality control. They help traditional suppliers adapt their technologies and meet semiconductor standards.

Future Outlook

The trend of traditional suppliers entering the semiconductor sector is likely to accelerate. As chipmakers continue to localize their supply chains, the demand for domestic materials and components will grow. This presents a unique opportunity for Taiwanese companies to diversify and innovate.

However, success will depend on several factors:

- Investment in R&D: Suppliers must continuously innovate to keep pace with the rapid advancements in semiconductor technology.

- Collaboration with Chipmakers: Close partnerships with chipmakers are essential to understand evolving requirements and develop tailored solutions.

- Access to Capital: The transition requires significant investment in new equipment and facilities. Government support and private investment will be critical.

- Talent Development: The semiconductor industry requires highly skilled engineers and technicians. Suppliers must invest in training and education programs.

Conclusion

The entry of steel, plastics, and display suppliers into Taiwan's chip sector is a testament to the industry's resilience and adaptability. It reflects a broader shift toward localization and vertical integration in response to global uncertainties. While challenges remain, the potential benefits for Taiwan's economy and its semiconductor industry are substantial. As these new suppliers mature, they will play an increasingly important role in securing the future of Taiwan's chipmaking dominance.

For more information on Taiwan's semiconductor industry and supply chain initiatives, visit the Taiwan Semiconductor Industry Association and the Industrial Development Bureau.

Comments

Please log in or register to join the discussion