The world's most advanced chipmaker is choosing to limit its own growth, creating openings for competitors and forcing its biggest customers to fund alternatives.

The semiconductor industry's most powerful company is deliberately choosing not to meet all the demand for its most advanced chips. TSMC's conservative capital expenditure strategy, while financially prudent, is creating persistent supply-demand imbalances that result in billions in foregone revenue. This calculated restraint isn't a failure of execution but a strategic choice that's reshaping the competitive landscape, pushing major cloud providers to actively cultivate rival foundries like Samsung and Intel.

The Economics of Restraint

TSMC's approach to capacity expansion reflects a fundamental tension in the semiconductor business: the choice between maximizing short-term market share and maintaining long-term profitability. The company's leadership has consistently argued that building fabs is "too expensive to chase every dollar." This philosophy has led to a pattern where TSMC's most advanced nodes—currently the 3nm family and the upcoming 2nm process—experience chronic shortages despite astronomical demand.

The numbers tell a stark story. In 2025, TSMC's 3nm capacity was reportedly oversubscribed by 300%, with Apple, AMD, Nvidia, and Qualcomm all fighting for allocation. The company could have doubled its 3nm output and still sold every wafer, but chose instead to maintain a deliberate scarcity. This strategy preserves pricing power and avoids the boom-bust cycles that have plagued other chip manufacturers, but it also means leaving money on the table.

Industry analysts estimate that TSMC's conservative approach resulted in approximately $8-12 billion in foregone revenue in 2025 alone. The company's gross margins remain industry-leading at over 55%, but the opportunity cost is substantial. More importantly, this constraint creates a structural problem for the entire technology ecosystem.

Hyperscaler Anxiety and the Multi-Foundry Strategy

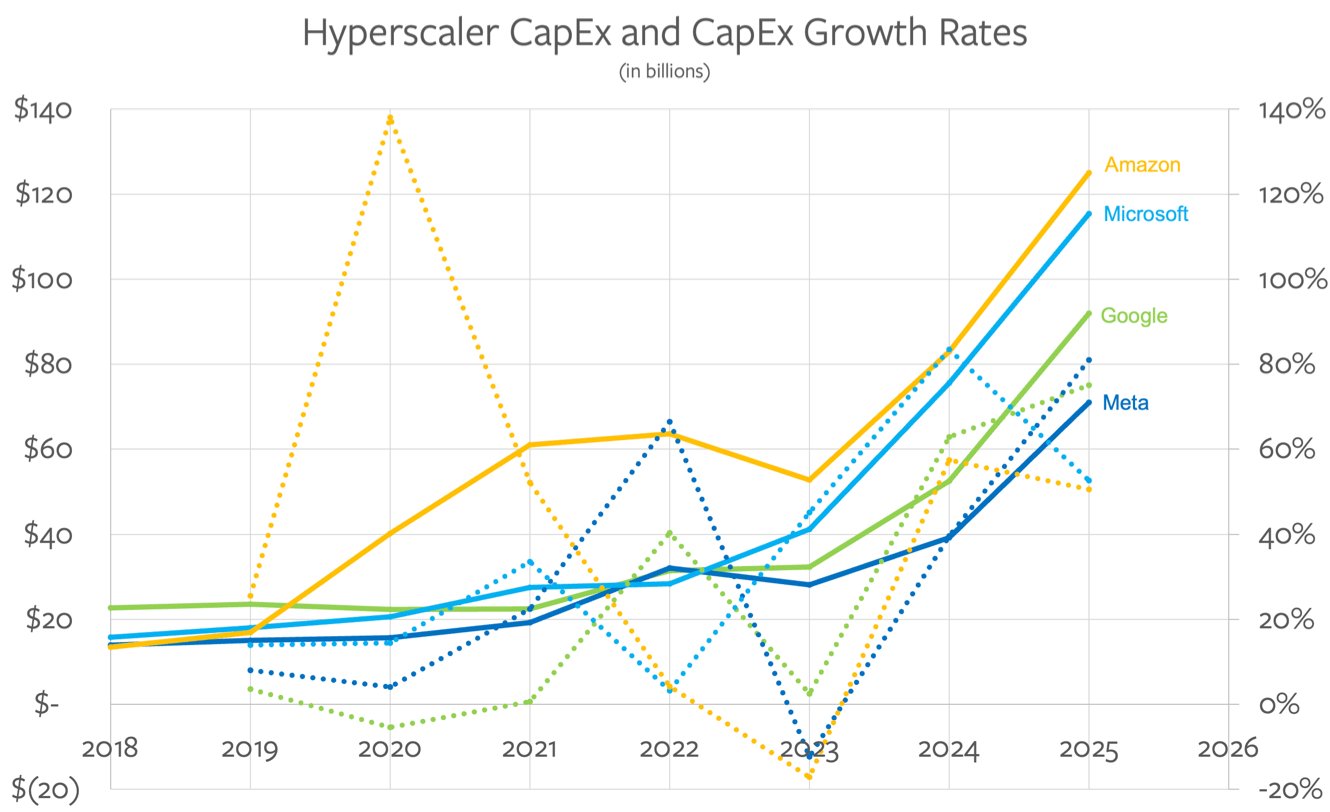

For companies like Amazon, Google, and Microsoft, TSMC's capacity limits aren't just an inconvenience—they're a strategic vulnerability. These cloud providers are increasingly designing their own custom silicon, from AWS's Graviton and Inferentia chips to Google's TPU and Microsoft's Maia accelerators. When TSMC can't provide enough capacity, these companies face production delays that directly impact their competitive position.

The response has been a quiet but determined push to develop alternatives. Amazon has reportedly committed over $1 billion to help Intel build out its foundry business, specifically to create a viable second source for its custom chips. Google has deepened its partnership with Samsung Foundry, particularly for its more specialized AI accelerators. Microsoft, while still heavily reliant on TSMC, has publicly supported Intel's foundry ambitions and is reportedly exploring multi-foundry strategies for future chip designs.

This represents a fundamental shift in the power dynamics of the semiconductor industry. For decades, TSMC has operated with near-monopoly power over leading-edge logic chips. Now, its biggest customers are actively working to reduce that dependency, not because TSMC's technology is inferior, but because its business model creates unacceptable risk for their roadmaps.

Samsung's Opportunity and Intel's Challenge

Samsung Foundry has been the primary beneficiary of this dynamic. The company has invested heavily in its 2nm and 3nm processes, using gate-all-around (GAA) transistor architecture that differs from TSMC's FinFET approach. While Samsung's yields have historically lagged behind TSMC's, the gap is narrowing. More importantly, Samsung offers something TSMC won't: guaranteed capacity for strategic customers willing to pay a premium.

The recent news that Samsung has entered the final qualification phase to supply HBM4 chips to Nvidia represents a significant milestone. If successful, this would mark one of the first major wins for Samsung in an area where TSMC has dominated. The 3.2% jump in Samsung's shares on this news reflects investor recognition that the market is finally diversifying.

Intel's foundry business presents a more complex picture. The company has committed over $100 billion to build new fabs in the US and Europe, but faces significant technical and operational challenges. Intel's 18A process, which uses RibbonFET transistors and backside power delivery, is theoretically competitive with TSMC's 2nm node. However, Intel must prove it can deliver consistent yields and meet the exacting standards of external customers—a challenge it has never faced as an integrated device manufacturer.

The hyperscalers' support for Intel is strategic rather than purely technical. By funding Intel's foundry development, they're buying insurance against TSMC's capacity constraints. Even if Intel's process is slightly behind TSMC's, having a viable second source for critical chips provides negotiating leverage and supply security.

The Counter-Argument: TSMC's Calculated Wisdom

Critics of TSMC's strategy miss the fundamental economics of semiconductor manufacturing. Building leading-edge fabs costs $20-30 billion each, with depreciation schedules spanning decades. The industry has a history of overcapacity leading to devastating price wars—witness the memory chip cycles that have bankrupted numerous manufacturers.

TSMC's conservative approach ensures the company never faces the existential threat of underutilized capacity. Its customers accept allocation limitations because they value the company's technological leadership and manufacturing excellence. The premium pricing TSMC commands—often 30-50% higher than competitors—reflects this quality differential.

Moreover, TSMC's capacity constraints force the entire industry to innovate. When chips are scarce, designers must optimize more aggressively, leading to more efficient architectures. The AI boom, for instance, has driven breakthroughs in chiplet designs and advanced packaging as companies work around capacity limits.

The Broader Pattern: From Monopoly to Managed Competition

What we're witnessing is the natural evolution of a mature industry. TSMC's dominance was never meant to be permanent; it was a function of technological leadership and capital intensity. As the industry matures, competition inevitably emerges, even if it's initially inferior.

The hyperscalers' multi-foundry strategies reflect a broader trend toward vertical integration in technology. Just as Apple designs its own chips to reduce dependency on Intel, cloud providers are building their own silicon ecosystems. This doesn't eliminate TSMC's role, but it does change the bargaining dynamics.

The semiconductor industry is entering a period of managed competition. TSMC will likely remain the leader in leading-edge logic for the foreseeable future, but its market share will gradually decline as Samsung and Intel improve. The result will be a healthier, more resilient supply chain—one where no single company holds the entire industry hostage to its capacity decisions.

For developers and technologists, this means more choices, potentially lower prices, and reduced risk of supply disruptions. The era of TSMC's unchallenged dominance is ending, not because of failure, but because of success. The company's conservative strategy created the very market gaps that competitors are now rushing to fill.

The real question isn't whether Samsung or Intel can catch TSMC, but whether they can reach a level of competitiveness that gives hyperscalers meaningful leverage. Based on current investment levels and strategic commitments, that day is coming sooner than many expect. The semiconductor industry's future will be defined not by one company's technological superiority, but by a carefully balanced ecosystem of competing foundries serving a demanding and increasingly sophisticated customer base.

Comments

Please log in or register to join the discussion