With AI infrastructure buildouts creating severe bottlenecks in high-bandwidth memory (HBM), DRAM, and NAND flash, semiconductor companies are escalating their supply chain diplomacy. From Jensen Huang's meetings with Samsung and SK Hynix to OpenAI's Sam Altman visiting TSMC, senior executives are now routinely deployed globally to negotiate allocations, signaling a shift where face-to-face commitment outweighs pure financial clout in securing critical components.

The global semiconductor supply chain is experiencing a profound shift in how critical deals are forged. As AI data center construction accelerates, creating unprecedented demand for high-bandwidth memory (HBM), DRAM, and NAND flash, companies are finding that traditional procurement channels are insufficient. The solution? Deploying the highest levels of executive leadership directly to supplier doorsteps.

Nvidia CEO Jensen Huang exemplifies this strategy. In a single week last October, he was seen dining with the heads of Samsung and Hyundai in Seoul, then meeting the joint chairman of SK Group's parent company, and finally visiting TSMC CEO CC Wei in Taiwan. These weren't ceremonial visits; they were targeted negotiations to secure memory supply for Nvidia's AI accelerators, particularly the H200 series destined for the Chinese market. Huang's trip to China, reported by multiple sources, aims to lobby for expanded import permissions for Nvidia's H200 AI accelerators, a critical component for AI training infrastructure.

This pattern extends far beyond Nvidia. OpenAI CEO Sam Altman made a "secret" visit to TSMC in late September 2025, followed by meetings with Foxconn executives. Both TSMC and Foxconn are essential suppliers for OpenAI's hardware ambitions, and Foxconn's partnership with SoftBank—which also invests in OpenAI—creates a complex web of dependencies that benefit from direct executive engagement.

Chinese tech giants are equally aggressive. Reuters reported that executives from Alibaba, ByteDance, and Tencent traveled to South Korea in October and November to lobby Samsung and SK Hynix for increased memory allocation. The pressure is intense enough that, according to Seoul Economic Daily, Microsoft, Meta, and Google dispatched purchasing executives to Korea in December to secure memory chips. Google allegedly terminated staff who failed to secure sufficient supply, highlighting the strategic importance of these components.

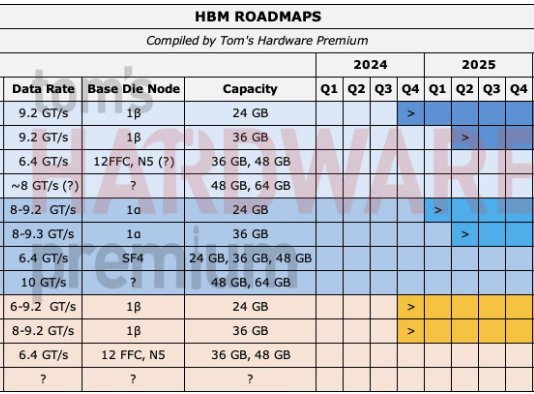

The memory market itself is experiencing historic tightness. High-bandwidth memory (HBM), which stacks DRAM dies vertically to achieve bandwidth exceeding 1 TB/s, is particularly constrained. HBM3 and the upcoming HBM3E are manufactured using TSMC's CoWoS (Chip-on-Wafer-on-Substrate) packaging, creating a bottleneck where packaging capacity limits overall output. Samsung and SK Hynix are the primary HBM suppliers, with Micron entering the market. The AI accelerator market, dominated by Nvidia's GPUs, requires HBM for training large language models, creating a direct competition between AI companies for limited memory output.

Traditional DRAM and NAND flash face similar pressures. The AI buildout requires massive amounts of memory for data storage and processing, while consumer electronics demand remains steady. This dual pressure has driven memory prices upward. According to industry sources, DDR5 memory prices increased by approximately 15-20% in Q4 2024, with HBM premiums reaching unprecedented levels.

The executive deployment strategy serves multiple purposes beyond simple procurement. Face-to-face meetings establish long-term commitment signals that reassure suppliers about sustained demand. For memory makers, seeing a CEO at the table indicates that the customer is serious about multi-year supply agreements, which justifies capital expenditure for capacity expansion. This is particularly crucial as memory fabs require billions in investment and 2-3 years to come online.

The strategy also addresses geopolitical friction. With US-China technology tensions affecting semiconductor trade, direct executive engagement helps navigate export controls and licensing. Huang's China trip specifically targets the H200 accelerator, which is designed for the Chinese market under US export restrictions. The H200 uses HBM3e memory but with reduced performance specifications compared to the full H200 available elsewhere.

Beyond memory, the supply squeeze extends to supporting materials. Apple and Qualcomm have reportedly visited Japanese and Chinese firms to secure glass cloth fibers, essential for printed circuit boards (PCBs) used in advanced chips. PCB drill bits, copper, and even electricity for data centers have become bottlenecked. The AI infrastructure buildout is so massive that it's creating shortages in seemingly unrelated industries.

The frequency of these executive visits reveals a structural change in semiconductor procurement. In normal market conditions, purchasing departments handle supply negotiations. In crisis conditions, where allocation is king and lead times extend beyond a year, CEOs become the ultimate negotiators. Their presence signals that the company will honor commitments, provide stable revenue streams, and maintain strategic partnerships.

This approach is particularly effective in East Asian business culture, where relationship building (guanxi in China, jeong in Korea) often outweighs transactional negotiations. A CEO's personal commitment can unlock allocations that might otherwise go to competitors with similar financial resources but less personal engagement.

The financial stakes justify the travel. Nvidia's data center revenue, driven by AI accelerators, reached $22.6 billion in Q3 2024 alone, up 279% year-over-year. This growth depends entirely on securing HBM and advanced packaging capacity. For memory makers, securing long-term contracts with AI giants provides the revenue certainty needed to justify multi-billion-dollar fab investments.

The trend shows no signs of abating. With AI model sizes continuing to grow—GPT-4 reportedly required over 10,000 GPUs for training, and future models will require more—demand for HBM and advanced memory will only increase. The next generation of AI accelerators, including Nvidia's Blackwell architecture and AMD's MI300 series, will push memory bandwidth requirements even higher.

For the broader semiconductor industry, this executive-driven procurement model represents a maturation of the AI supply chain. It acknowledges that technology leadership alone isn't enough; supply chain mastery is equally critical. Companies that master this dual challenge—innovation and supply chain diplomacy—will dominate the AI era. Those that don't may find themselves with brilliant designs but no components to build them.

The restaurant tables of Taiwan and the boardrooms of Seoul have become the new battlegrounds for AI supremacy. In this environment, a CEO's handshake can be worth more than a billion-dollar purchase order, because it represents a commitment that transcends quarterly earnings and aligns the strategic futures of both supplier and customer. As the AI revolution continues to reshape the semiconductor landscape, these personal relationships will increasingly determine which companies lead and which follow.

Comments

Please log in or register to join the discussion