Japan's Kirin Holdings is creating a new Australian subsidiary to centralize its health science B2C operations, marking a strategic shift from beer to health foods and supplements as it targets major Asia-Pacific market share.

Japan's Kirin Holdings is making a significant strategic pivot from its beer roots by establishing Kirin Health Science International, a new wholly owned subsidiary headquartered in Sydney, Australia. The move, announced on February 13, 2026, represents the company's latest effort to consolidate its health science business-to-consumer operations under a unified global brand strategy.

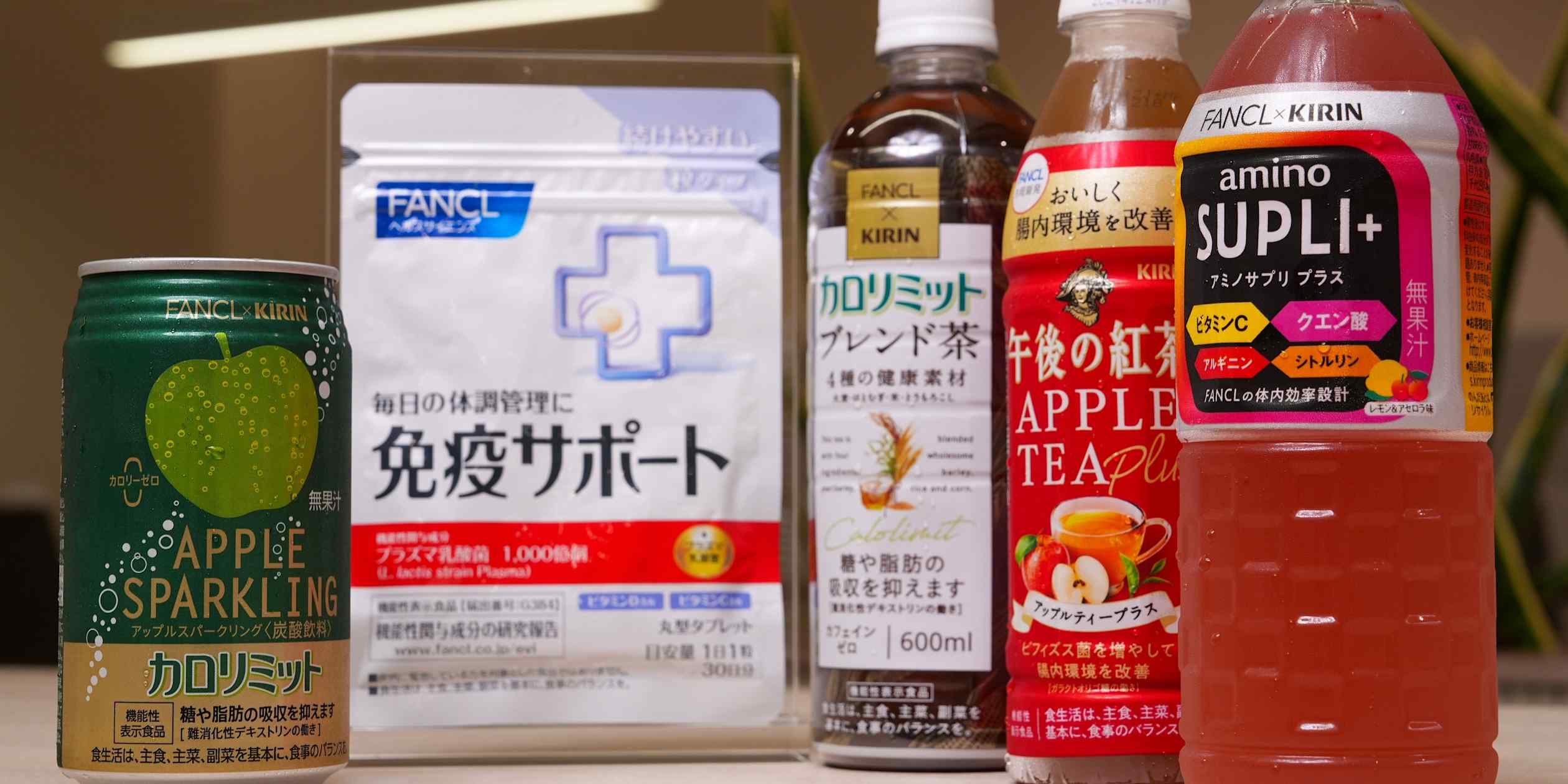

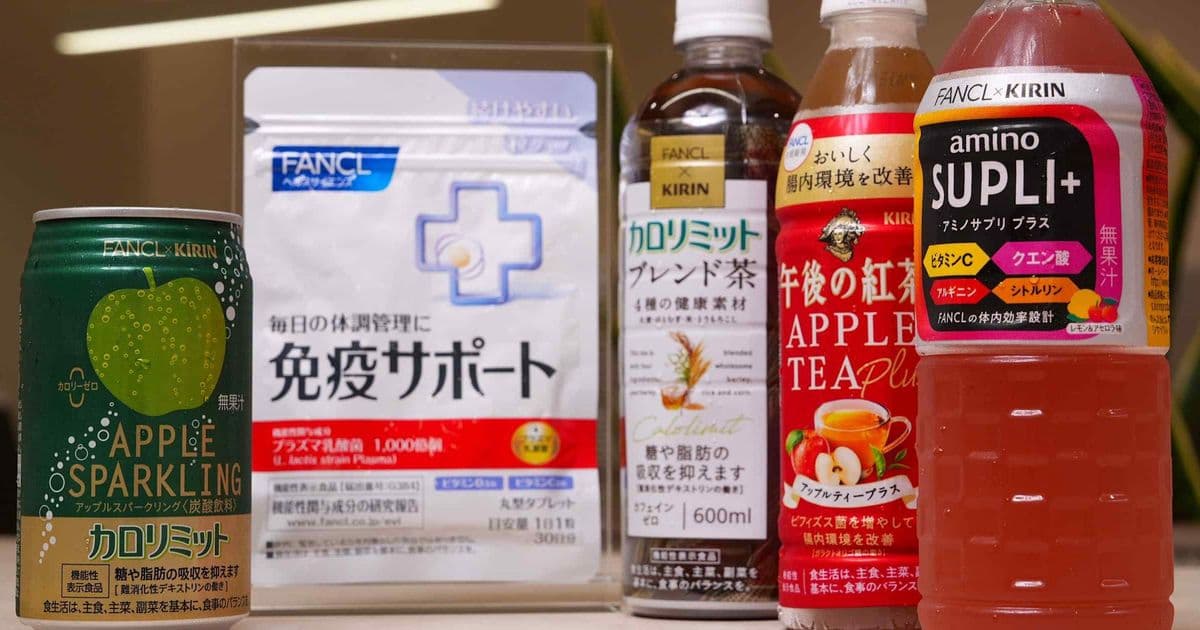

The decision to centralize operations in Australia comes after Kirin's aggressive expansion into the health sector, including its 2023 acquisition of Australian health food giant Blackmores and the 2024 purchase of skincare and supplement maker Fancl. These acquisitions, totaling billions in investment, signal Kirin's commitment to becoming one of the largest health science companies in the Asia-Pacific region.

Kirin President and COO Takeshi Minakata emphasized the strategic importance of this move during a Friday briefing, stating that the health science business, designated as a formal business segment in 2023, had already achieved profitability in 2025. "We want to make it the group's top growth driver going forward," Minakata said, highlighting the company's confidence in the sector's potential.

The new Australian hub will manage Kirin's proprietary health ingredients, particularly the Lactococcus lactis strain Plasma (LC-Plasma), a type of lactic acid bacterium that has become a cornerstone of the company's health product portfolio. By centralizing these operations, Kirin aims to enhance business efficiency and competitiveness in the rapidly expanding global health and wellness market.

This strategic shift stands in stark contrast to Kirin's Japanese competitors. While Asahi Group Holdings continues to focus on globalizing its alcoholic beverage business through acquisitions in Europe, Australia, and now Africa, and Sapporo Holdings has decided to sell its profitable real estate business to concentrate on alcoholic beverages, Kirin is betting heavily on health science.

The timing of this announcement is particularly noteworthy, coming just days after Kirin revealed plans to sell its Four Roses bourbon brand to E. & J. Gallo Winery for up to $775 million. The proceeds from this divestment are expected to fund further investments and acquisitions in the health science sector, creating a virtuous cycle of growth and reinvestment.

Kirin's health science strategy has not been without challenges. The company faced opposition from activist investors when it first announced its diversification plans, with critics questioning the wisdom of moving away from its core beer business. However, Minakata noted that the company's persistence has paid off: "We now believe this direction has earned the trust of the market and received a certain level of recognition."

The establishment of the Australian hub also reflects broader market trends. As global alcohol consumption declines amid rising health consciousness, particularly among younger consumers, traditional beverage companies are seeking new growth avenues. Kirin's early and aggressive move into health science positions it well to capture this shifting consumer demand.

Australia's selection as the hub location is strategic, given the country's established reputation in health and wellness products, particularly in the Asia-Pacific region. The proximity to Blackmores' operations and Australia's strong regulatory framework for health supplements make it an ideal base for Kirin's expanded health science ambitions.

Industry analysts view this move as a calculated risk that could pay significant dividends. The Asia-Pacific health and wellness market is projected to grow substantially over the next decade, driven by aging populations, rising disposable incomes, and increasing health awareness. By establishing a dedicated hub now, Kirin is positioning itself to capture a significant share of this growth.

The success of this strategy will depend on Kirin's ability to effectively integrate its acquisitions, leverage its proprietary health ingredients, and build a compelling global brand in the competitive health science sector. The company's willingness to divest from traditional businesses like bourbon to fund this expansion demonstrates its commitment to this new direction.

As Kirin Health Science International prepares to launch in April 2026, the company's transformation from a beer maker to a health science powerhouse will be closely watched by industry observers and competitors alike. If successful, Kirin's strategy could serve as a blueprint for other traditional beverage companies seeking to navigate the changing landscape of consumer preferences and health consciousness.

Comments

Please log in or register to join the discussion