The Trump administration proposes tariff exemptions for TSMC chips imported by U.S. hyperscalers, contingent on the foundry meeting its pledged $165 billion investment in American semiconductor manufacturing amid global supply chain realignment.

The U.S. Department of Commerce is negotiating conditional tariff exemptions for chips produced by Taiwan Semiconductor Manufacturing Company (TSMC), directly linking import relief to the scale of TSMC’s manufacturing investments on American soil. This follows January’s announcement of 15-20% tariffs on advanced semiconductor imports, with exemptions now structured around TSMC’s commitment to invest $165 billion in U.S.-based fabrication facilities. Under the proposed framework, tariff exemptions would apply specifically to chips supplied to major U.S. technology firms including Google, Microsoft, Amazon, and Meta.

Central to the arrangement is a complex quota system tied to production capacity. Companies building new U.S. fabs would receive tariff exemptions for imports amounting to 2.5 times their planned American production capacity during construction, while existing U.S. facilities qualify for 1.5 times their capacity. This incentivizes rapid scaling of domestic production, though specific allocation formulas remain undefined. The deal originates from broader U.S.-Taiwan trade negotiations where reduced Taiwanese import tariffs (from 20% to 15%) were exchanged for $250 billion in Taiwanese investments in American semiconductor infrastructure, with TSMC shouldering the majority as the world’s dominant advanced node manufacturer.

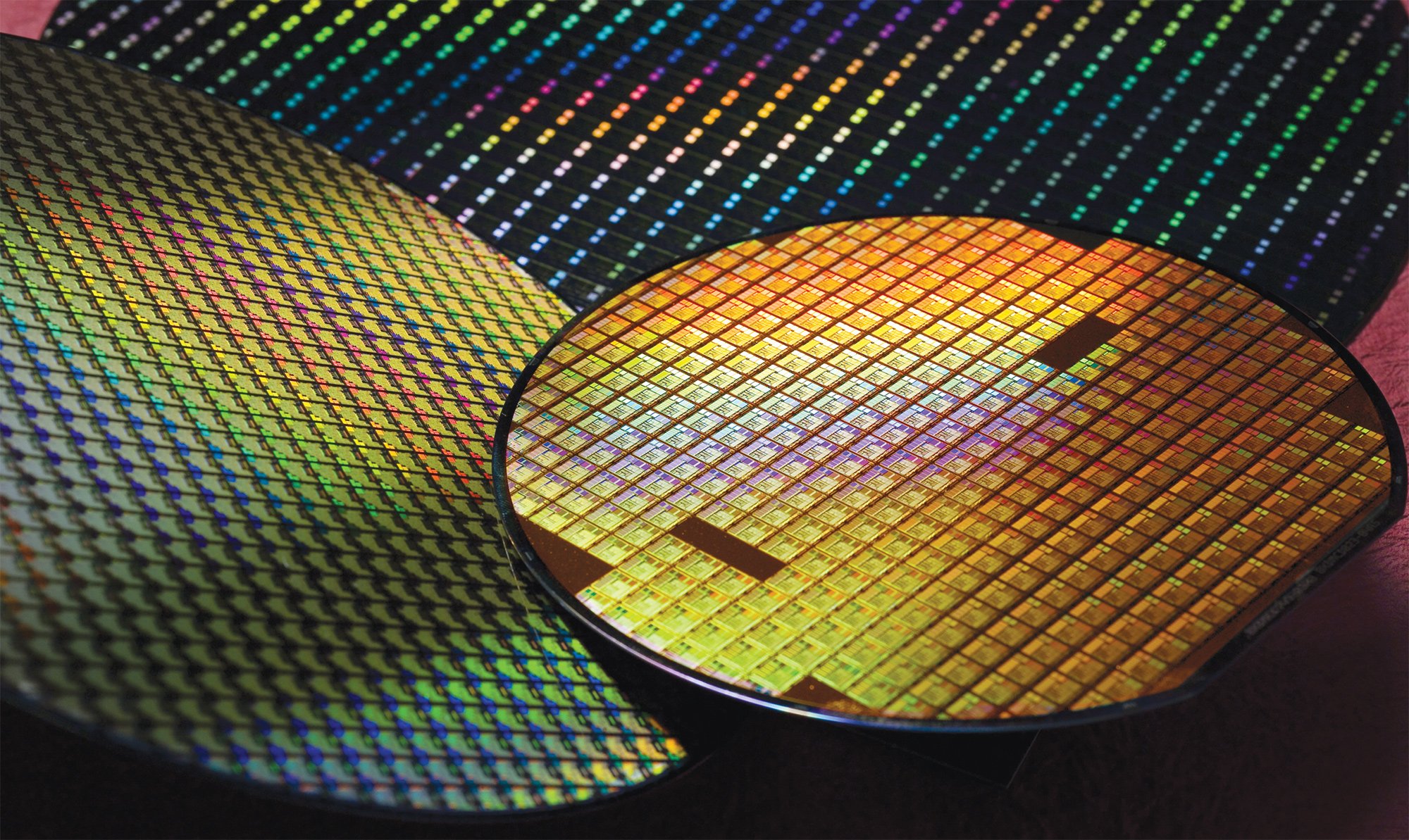

TSMC currently operates two Arizona fabs targeting 5nm and 3nm process nodes, with plans for additional facilities. However, scaling U.S. output to meet 40% of its global capacity—a target implied by U.S. officials—faces significant hurdles. The company’s Phoenix campus represents its largest foreign investment, yet transitioning advanced node production (sub-3nm) requires substantial workforce development and supply chain integration. TSMC’s 2nm (N2) node enters risk production in 2025, while U.S. facilities won’t achieve equivalent scaling before 2027. Current Arizona production focuses on 4nm and 5nm wafers, with yields reportedly reaching 80% of Taiwan benchmarks.

Market implications extend beyond bilateral agreements. This tariff structure accelerates the global semiconductor reshoring trend, with the EU committing €43 billion to its Chips Act and China developing domestic 7nm capabilities despite export restrictions. For TSMC, the $165 billion U.S. commitment introduces financial exposure: An AI compute demand bubble could leave expanded capacity underutilized, particularly given parallel U.S. investments in Intel’s foundry business. Industry analysts note TSMC’s Arizona operational costs run 30% higher than Taiwan, exacerbated by U.S. labor expenses and material logistics. The foundry must balance geopolitical pressures against market realities—overcommitting risks stranded assets if demand plateaus, while underinvesting forfeits tariff benefits and hyperscaler partnerships. With AI accelerator shipments projected to grow 35% annually through 2028, TSMC’s capacity allocation decisions will critically influence both U.S. tech competitiveness and global semiconductor supply chain dynamics.

Comments

Please log in or register to join the discussion